INNOVATION | 09.09.2024

2024: a challenging year for the insurtech ecosystem in Latin America

The insurtech ecosystem in Latin America is going through a difficult time. In spite of the resilience expected due to the growing number of startups and the low mortality rate, investors are investing less and less, with levels down to historic lows. Although the ecosystem remains strong in the first half of 2024, the final stretch of the year is challenging, with a very clear need for an injection of capital to boost market development in the coming years.

The world economy continues to decelerate, although it’s managing to maintain positive growth thanks to inflation rates that have been gradually declining in recent months. MAPFRE Economics, MAPFRE’s research arm, anticipates in its latest report growth of 3% for 2024 and 2.9% for 2025.

In the specific case of Latin America, the report states that growth of 1.3% is expected at the end of the year, increasing to 2.1% in 2025. The forecast for 2024, although low, goes along the lines established by public and banking institutions in the region. For example, the United Nations Economic Commission for Latin America and the Caribbean (ECLAC) forecasts growth of 2.1%, 0.8 points higher, but also maintaining the path of low economic growth observed in recent years.

In this context, finding new formulas to boost growth is critical, especially given the development opportunities that still lie ahead for the region. One of these mechanisms is investment in physical and human capital: more and better investment is needed. The ECLAC points out that this involves “adopting new technologies, promoting cluster initiatives and good business practices, fostering in-depth improvements in the capital accumulation process and making the most of economies’ social and environmental capital”.

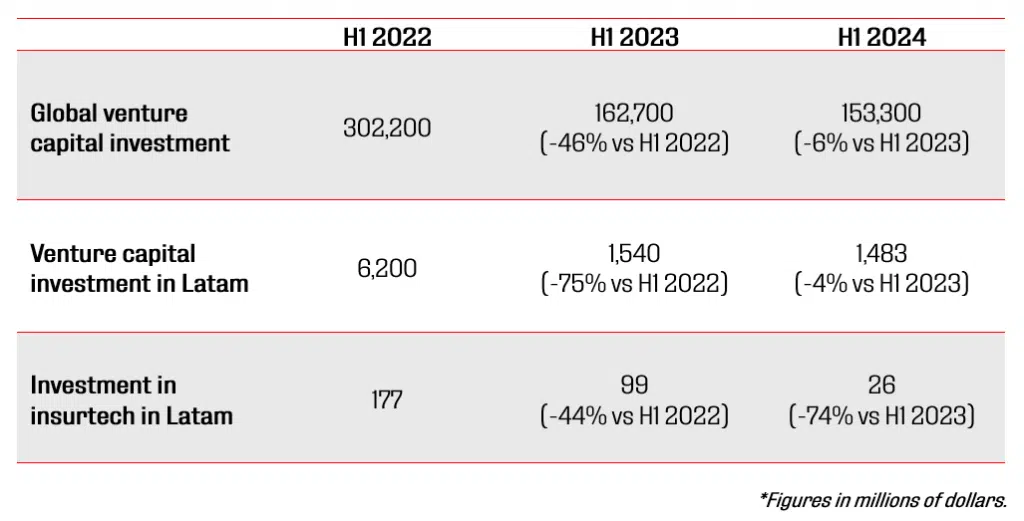

“What we are seeing worldwide is a reduction in investment in global venture capital since 2022 as a result of the slowdown in the economy”, noted Carlos Cendra, Scouting & Investment Lead at MAPFRE Open Innovation. “As a result, venture capital investment in Latin America has also decreased, and the specific insurtech market has not been spared. While public bodies and public-private partnership spaces are trying to incentivize financing, the reality is that investors are taking a more detailed look at where to focus, and that is being reflected in the latest sector data”, he adds.

Chart 1: VC investment figures (2022-2024)

Less financing, but more insurtech

As of July 2024, Latin America has 498 insurtech startups. According to the LATAM Insurtech Journey report, estimates indicate that this is 7% of the insurtech ecosystem and less than 1 percent of its total financing. These nearly 500 startups represent growth of 6 percent in the last 12 months.

In this first half of the year, startups have received investment of $26 million, which is 78% less than in the same period of 2023. Over the last 12 months (July to July), 43 million dollars was invested, the lowest amount in history.

The situation is therefore paradoxical: there is less funding than ever, but entrepreneurs remain strong, keeping their bets on the sector. In principle, all of this might be seen as a negative situation: investors are not committed to this market and there are increasingly more players among whom to distribute scarce capital.

“We cannot deny that the situation is difficult and investment levels are low. However, it should also be borne in mind that we are not seeing anything that does not generally happen in the venture capital sector and that not all funding rounds are made public, so the real picture from now until the end of the year may not be so negative. We’ll have to wait”, Carlos Cendra says. “The year 2024 is a challenging one for the Latin American ecosystem, but there are still reasons to remain hopeful and stay committed to the region”, he concludes.

One of the reasons is the growth in the number of startups mentioned above. Apart from that +6%, if we add that the mortality rate has fallen to 10%, the expert at MAPFRE Open Innovation points out that “the ecosystem is resilient, and entrepreneurs continue to seek new formulas, models and businesses to revitalize the sector. Latin America has great potential, more so at a time when the insurance gap is gradually shrinking, and new players are clear about the potential”.

Brazil: leader of the region

Breaking down the total number of startups in the region, Brazil leads with 203, followed by Chile (72) and Colombia (67). The Pacific region shows the highest percentage growth, notably Central America (69%), Ecuador (35%), Colombia (24%), and Peru (23%).

"The exceptional nature of the Brazilian market is worth highlighting. Due to the language – as the only non-Spanish-speaking Latin American country -, with a very endogamous market and owing to its economic potential, it stands as a territory with very specific needs that are not always easy to meet. Hence it is a predominantly internal market, with little international expansion and that is less attractive to foreign companies”, Carlos Cendra explains. As a result, it has the highest insurtech mortality rate in the region, with 12 percent.

During the first half of 2024, international expansion grew by 11%, with a total internationalization index of 13.4%. Multilatina insurtech startups, operating in multiple countries, represent 13% of the market. Peru (42%) and Chile (30%) are driving this expansion due to their business scalability needs, while Brazil exports very few insurtechs (<1%) due to its unique market dynamics.

The attracting index for foreign companies stood at 24.2%, + 3.3% compared to the beginning of 2024, when it was 20.9%. Peru (63%), Ecuador (48%), Colombia (43%) and Mexico (31%) are the Latin American countries that draw the most foreign insurtech companies.

In this context, the expert from MAPFRE Open Innovation indicates that "if we look at the Latam Insurtech Journey report, the latter notes that 92 percent of startups that do not survive are the local ones. In addition to the growth of multi-Latin players, a clear trend that we are seeing is that operating in more than one country is critical for the survival of businesses, both in terms of operations and sales, and for positioning oneself as an attractive insurtech for investors”.

The biggest investments in 2024

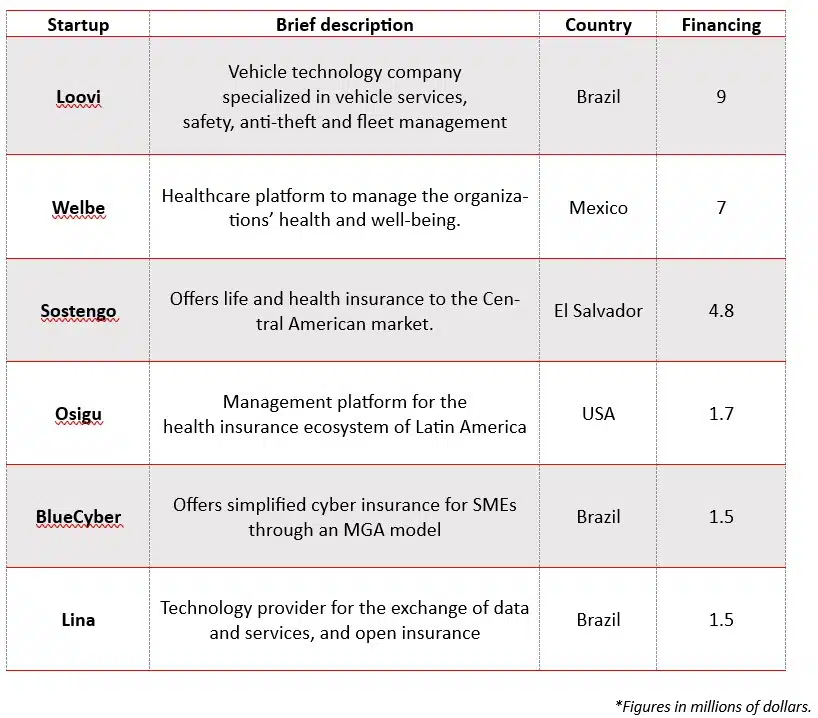

As indicated above, not all funding rounds are public. But taking into account the ones that are, the following were the largest investments in the first half of 2024:

Chart 2: insurtech startups with the most funding in H1 2024. Data from Latam Insurtech Journey.

“It reflects very well on Latin American entrepreneurs that, despite low investment, the ecosystem continues to be strongly committed to creating and promoting new startups to help the sector grow, thus furthering the reduction of the insurance gap. Latin America is remarkably resilient and a highly attractive region for both local and international investors. We will have to closely monitor the coming months. If investment in venture capital does not grow, and if that continues, 2025 will be a very difficult year and with a high mortality rate in the industry”, concludes Carlos Cendra, Scouting & Investment Lead at MAPFRE Open Innovation.

RELATED ARTICLES: