INNOVATION | 05.11.2024

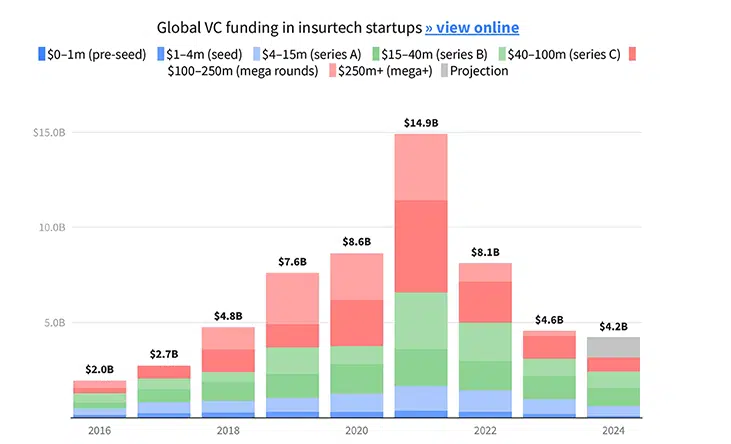

Global insurtech funding stabilizes and is expected to reach $4.2 billion by the end of 2024

- The third quarter of 2024 closed with an investment in insurance technology (insurtech) of $3.2 billion, 7% less than in 2023. However, the trend is positive and suggests a rebound in funding in the fourth quarter, marking the ecosystem’s stability at 2018 levels.

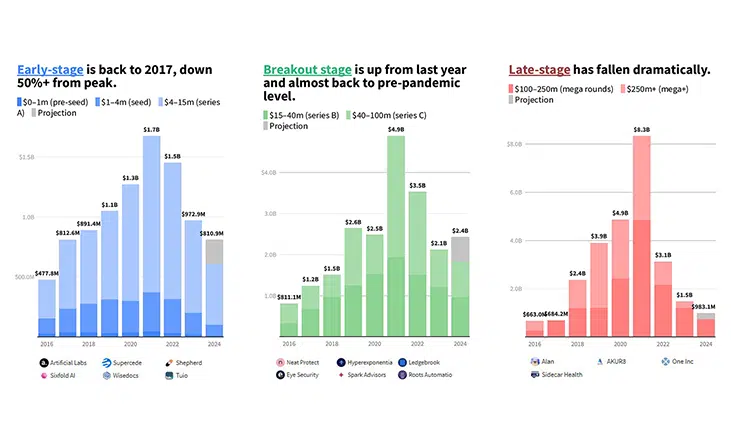

- The stabilization in insurtech funding is being led by breakout-stage companies (Series B and C), which are showing notable recovery and approaching pre-pandemic funding levels. Early-stage startups (pre-seed, seed, and Series A) are also contributing to this stabilization. In contrast, late-stage startups continue to face challenges, with funding levels lagging behind, reflecting the broader market’s cautious stance on mature, high-valuation companies.

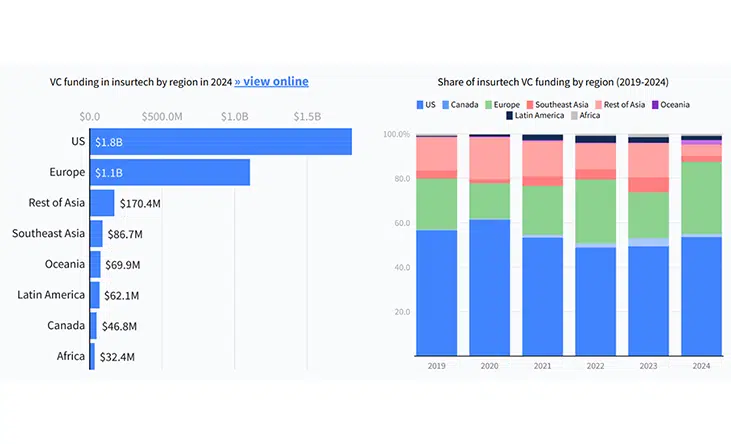

- By region, the United States continues to be the main driver of growth, with an investment of $1.8 billion. Europe is next with $1.1 billion. This highlights a significant gap compared to emerging markets such as Africa and Latin America, with funding of $32.4 million and $37.1 million, respectively.

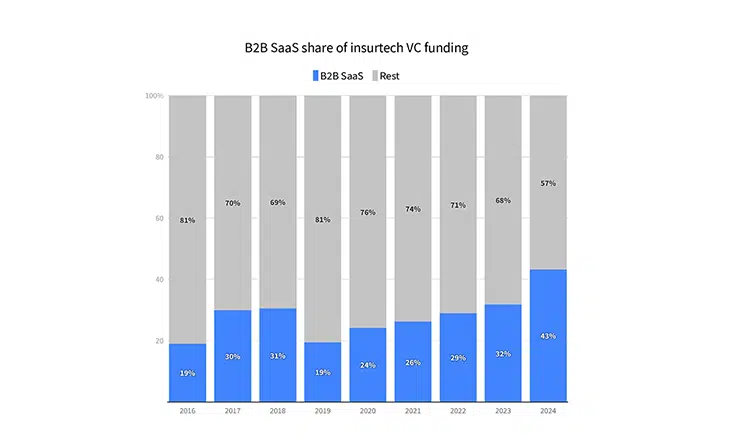

- 43% of insurtech funding has been captured by B2B Software as a Service (SaaS) startups. This includes providers of payment solutions, risk management and underwriting software, or claims management and administration. Many of these companies base their offerings on artificial intelligence (AI) or are expanding their portfolios with new AI products.

Venture capital funding in insurance technology (insurtech) startups is seeing signals of stabilization driven by the breakout-stages startups (the ones in Series B and C founding stages). Specifically, it is expected to reach $4.2 billion by the end of 2024, similar to the figures in 2018 and 2023.

During the first three quarters of the year, funding has reached $3.2 billion, 7% less than in 2023. Nevertheless, the trend is positive and suggests a rebound for the year’s final stretch. Late-stage startups (those seeking funding rounds of over $100 million) are experiencing the greatest decline, with a drop of nearly 90% compared to their 2021 peak. However, these will drive the final funding push before closing 2024, as many have been working on reinforcing their unit economics to be ready for the exit in the upcoming years.

These are some of the main conclusions from the report ‘The State of Global Insurtech,’ prepared by Dealroom.co, Mundi Ventures, and MAPFRE. This is the fourth edition of a report that analyzes the state of the insurtech industry, providing transparency through qualitative data and information on trends and the current state of the sector.

Figure 1: Venture capital investment in insurtech startups. Source: Dealroom.co. Closing data as of September 27, 2024.

Early-stage and late-stage startups still far from their peaks

While the lack of funding for late-stage startups is the main cause of the current state of the ecosystem, small companies in the pre-seed, seed, or Series A phases are also slow to stabilize, with a 50% decline compared to their peak in 2021.

As for those in Series B or C, their funding has been the highest among all, and projections indicate it will reach $2.4 billion by the end of 2024. These figures place their current situation at pre-pandemic levels, supporting the stabilization the market is experiencing.

Figure 2: Investment by startup type. Source: Dealroom.co. Closing data as of September 27, 2024.

Insurtech Challengers (1.0) are evolving tech market dynamics and the insurance industry’s shifts have helped them recognize core insurance challenges and demonstrate their value. This is reflected in their stock performance, which has shown marked growth over the past two years.

The United States and Europe lead in investment

Analyzing the insurtech market by geography, the United States continues to lead in investment, followed by Europe ($1.8 billion and $1.1 billion, respectively). Both regions are showing fairly positive performance, and the trend indicates they will continue this way.

Emerging markets like Latin America are struggling more to attract investors, remaining at historical lows with $37.1 million in funding. However, the insurance penetration gap is gradually narrowing on the continent, so growth prospects remain optimistic. Also, there’re internal rounds that aren’t public, and investors are starting to look closer on the region, with positive perspective for the near future.

Figure 3: Investment by region by 2024 Source: Dealroom.co. Closing data as of September 27, 2024.

B2B SaaS startups capture 43% of funding

Companies within the insurtech ecosystem focused on Software as a Service (SaaS) with a B2B (Business to Business) business model have secured 43% of total funding, the highest rate in history.

This group of startups includes providers of software, pricing, risk management, underwriting, administration technology, and reinsurance technology, among others. Additionally, many of them base their offerings on artificial intelligence (AI) products or are expanding their portfolios with new AI-focused solutions.

Figure 4: Percentage of funding captured by B2B SaaS companies. Source: Dealroom.co. Closing data as of September 24, 2024.

The life and health (L&H) segment has attracted 50% of funding this year, matching the property and casualty (P&C) segment for the first time in three years. In the former, the main driver has been the health sector; in the latter, climate risks and business insurance.

Regarding major trends in the industry, generative AI, climate risks, and health are three areas where the industry is focusing more this year.

Generative AI is beginning to optimize insurance processes, but significant efforts are still needed from large companies, particularly in raising awareness and educating society by providing preventive measures to reduce risks for individuals and businesses. The area of climate risks has received considerable and stable funding since 2021. Regarding the healthcare sector, as chronic diseases account for 70% to 90% of healthcare expenditures in developed markets, preventive care, early intervention, and improved management are becoming increasingly important.

Quotes

Javier Santiso, CEO and General Manager, Mundi Ventures, states: “After the uncertainty of previous years, the global insurtech market is now showing signs of further stabilization. While the frenzy has cooled, weʼre seeing a positive rebound in the early-growth / breakout stages, particularly with Series B funding picking up.

However, the late-stage market remains significantly constrained, with a freeze in growth and IPO phases. Many startups are now gearing up for potential IPOs in 2025 or 2026, setting profitable models and waiting for more favorable market conditions. This cautious environment is shifting investor focus towards proven business models with solid unit economics”.

Leire Jiménez, Chief Innovation Officer, MAPFRE, affirms: “What we are seeing worldwide is a slowdown in the economy since 2022, which is directly impacting investment in insurtech venture capital, some geographies more than others. US and Europe, for example, are back on track and showing an optimistic performance.

However, Asia and Latin America are struggling to raise, the latter with funding at historic lows. Still, the Latin American ecosystem is resilient, and entrepreneurs continue to seek new formulas, models, and businesses to revitalize the sector. The region has great potential, more so at a time when the insurance gap is gradually shrinking due to the large volume of opportunities in it. Collaborative spaces and public-private partnerships are key to stabilize the market and drive it forward”.

Yoram Wijngaarde, Founder and CEO, Dealroom.co, highlights: “Insurance is a vast industry that has been largely unchanged for hundreds of years. It remains a huge target for tech efficiency and scale, but one that has been difficult to crack. Insurtech 2.0 is unbundling the challenge, zeroing in on niches like B2B SaaS, risk management, climate and cyber, with greater traction. Global breakout stage investment is on track to grow year on year in 2024, and European insurtech VC has already passed 2023’s total. Insurtech is iterating”.

You can read the full report here.