ECONOMY | 06.18.2024

Freaky Friday: What is the quadruple witching hour on the Stock Exchange?

Four days a year, markets are under a kind of “spell.” Every third Friday in March, June, September, and December, Stock Exchanges record a strong increase in trading during a specific time, which can sometimes cause “strange” movements in asset prices. This is what is known as the quadruple witching hour, and it is the moment when, simultaneously, the quarterly expiration of futures and options on indices and stocks occurs.

The etymological origin of this concept lies in British literature, specifically William Shakespeare. The term “witching hour” is considered to have originated from the three witches in Macbeth because there are strange movements in the market in a short time, as if they were spells.

To understand this intriguing and historical phenomenon, we must first understand the complex world of the derivatives market. Derivatives are financial instruments whose value depends on an underlying asset (for example, stocks) and are structured as forward contracts. Two of these derivatives are futures and options.

What are futures and options?

A future is a contract with which an agreement is reached to exchange an asset on a future date at a previously agreed price. The “expiration” of this contract is when the seller of the future must sell the underlying asset to the buyer of the future at the agreed price.

An option is certainly more complex. While in the futures contract the parties have the obligation to execute the operation at the time of expiration, with an option the buyer has the “right” to decide whether or not the operation is closed.

Let's give an example: an investor thinks that share X, which is now 28 euros, can rise in the next three months. To benefit from this increase, the investor decides to buy a call option that expires in three months, which will give them the right to purchase that share in three months. To do so, they pay a premium to the seller of the call option. Let's say that premium is quoted at 3 euros. If at the time that this option expires, the share price is more than 31 euros (28 + 3), the buyer of the option will exercise their right to purchase.

Derivatives are complex and risky instruments, but they are used by more sophisticated investors to maximize profits.

What happens during quadruple witching hour?

Every third Friday in March, June, September, and December marks the simultaneous expiration of futures and options on indices and stocks. If this moment is known as the quadruple witching hour, is because the expiration of contracts has historically affected the price of underlying assets (indices and stocks). So much so that it seemed like the market was “enchanted.”

But why can this expiration simultaneously affect the price of the underlying assets? To meet the delivery obligations of futures contracts and stocks, the underlying asset must be available. Many investors wait until the last moment to check the market status, so many operations usually occur on the same day the contract expires.

This inevitably leads to an increase in trading volume. Historically ,this increased trading volume resulted in higher volatility. However, there is no causal relationship between these two phenomena.

Why have the effects of the quadruple witching hour been softened?

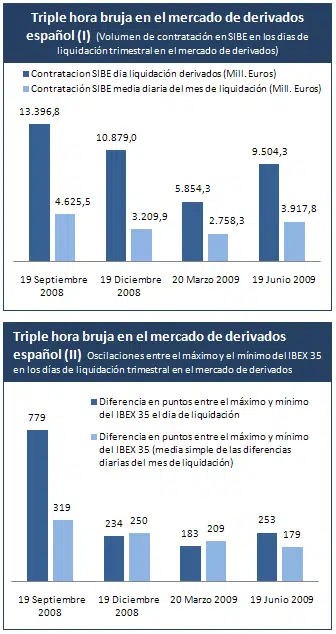

Source: BME

This BME chart illustrates why an increase in trading volume does not always lead to increased volatility on quadruple witching days.

The first figure shows the trading volume of the Ibex 35 on the days of simultaneous expiration between September 19 and June 19, along with the average daily trading volume for that month. The second figure shows the daily fluctuation of the Ibex between the daily high and low on quadruple witching days and compares it with that fluctuation on the average daily for the same month.

As can be observed, while the trading volume is always higher on quadruple witching days compared to the daily average of that month, there are occasions when the Ibex has had less volatility on simultaneous expiration days than on the daily average of the month.

In summary: quadruple witching hour typically accompanies an increase in trading volume but not always in volatility. This is the case for several reasons. In Spain, the derivatives market not only has quarterly expirations, but also monthly ones, which spreads out the trading activity.

In addition, digitalization has also mitigated the effects of this stock market phenomenon. By automating trades, many investors do not rush to close their positions at the last minute, thereby containing volatility.

When does the quadruple witching hour take place?

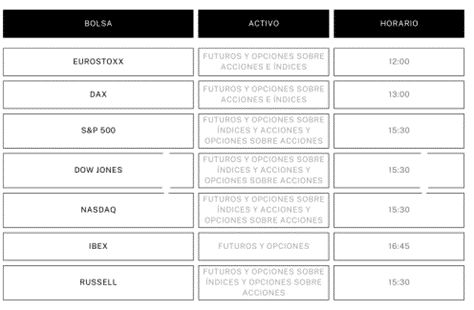

As we have already mentioned, the simultaneous expiration of futures and options on indices and stocks takes place every third Friday of March, June, September, and December. However, it is not until a specific time on those days when the expiration of those contracts takes place.

In each market it is usually done at a different time. It should also be noted that not all markets have a quadruple witching hour. In the United States, for example, it is only a triple witching hour, since in this market there are no futures on stocks.

Prepared by the authors

How to trade on simultaneous expiration days?

Although experts agree that nowadays extreme volatility is not common on quadruple witching days, investors should be prepared for a possible sharp movement in the financial markets.

Therefore, it is especially useful to know procedures such as stop loss, which allow to determine a maximum loss. This is a sales order that is executed immediately when a previously given price is reached.

In conclusion, the quadruple witching hour can generate strong volatility in the market and, therefore, represents a risky moment for investors. Only those who are professionals and willing to take very high risks should operate in these high-uncertainty environments.

RELATED ARTICLES: