ECONOMY| 11.27.2024

From inflation to Trump: the Economic Observatory Forum hosted by MAPFRE and El Confidencial analyzes Europe’s challenges

The Economic Observatory organized by MAPFRE and El Confidencial closed its first year with the celebration of a Forum in Madrid that analyzed the challenges and trends that will shape the global and Spanish economies.

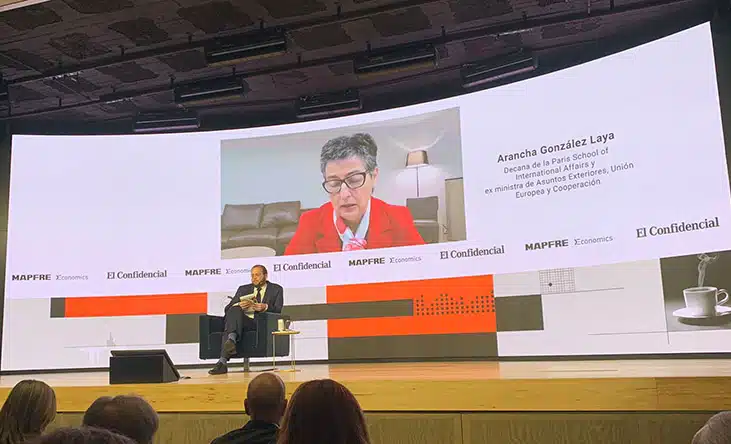

This first edition of the MAPFRE – El Confidencial Forum was attended by, among others, the Vice Chairman of the European Central Bank (ECB), Luis de Guindos, the former Minister of Foreign Affairs of Spain in 2020 and 2021, Arancha González Laya, and the CEO of MAPFRE, Antonio Huertas, among others, together with top analysts who discussed topics such as the upcoming scenario for Europe following Donald Trump’s victory in the U.S. and the direction of monetary policy in the Old Continent.

These were all the speeches:

The CEO of MAPFRE sees “very positive prospects” for insurance

Antonio Huertas, CEO of MAPFRE, took the floor to open the event, reaffirming the company’s commitment to becoming an “important player in the public debate.” For Huertas, the general economic situation “is evolving very well,” although uncertainties persist that could cause new economic turbulence, such as geopolitics (e.g., the war in Ukraine or the conflicts in the Middle East).

In this global context, the insurance industry has “very positive prospects” and, “now that inflation is under control,” lines such as automobiles will again yield “very good results.”

Guindos points to new rate reductions

The Vice Chairman of the European Central Bank and former Minister of Economy between 2011 and 2018, Luis de Guindos, confirmed that the evolution of inflation is “positive” and that ECB forecasts for 2025 expect this slowdown to continue. After recalling the three rate cuts that have already taken place this year, Guindos stated that “The direction of monetary policy is clear: if the projections are met, it will lead to a reduction in the level of restriction.”

The ECB executive stated that climate risks “will be increased by climate change,” mentioning the enormous rainfall in Valencia and southeastern Spain. He believes that the affected area will be rebuilt quickly, and insurance companies and banks will “play an important role” in this process.

With regard to Donald Trump’s victory in the U.S. elections, Guindos has shown peace of mind because he believes that “the fundamental elements” of U.S. policy will remain, as will its relationship with Europe, trade flows, and the independence of Federal Reserve’s monetary policy.

Europe’s relationship with the Trump’s U.S.

The first roundtable discussion of the forum delved into Europe’s situation in the post-election scenario of the U.S.

Manuel Aguilera, General Manager of MAPFRE Economics, expressed the opinion that the rally of optimism in the markets after Trump’s victory is simply “the conclusion of electoral uncertainty.” Aguilera sees risks in three scenarios: the start of trade tensions; fiscal policy and its impact on inflation and economic growth; and geopolitical terrain, with changes in direction in conflicts such as the Middle East.

Judith Arnal, a senior researcher at the Center for European Policy Studies and the Elcano Royal Institute and director of the Bank of Spain, believes that, despite fears about Trump’s possible economic decisions, “the truth is that, before being a politician, he is a businessman, and it is very likely that he will adopt a transactional stance, with the current positions being starting points in a negotiation.” The doubt, therefore, is “what elements he asks from Europeans in return.”

José Manuel González Páramo, President of the European DataWarehouse, expressed his concern for the financial aspect, and the possibility that Trump may start a battle with the Fed, although he will probably “lose.” “There will be a lot talk, but no action, I hope,” he predicts. However, he stated that the key point is the direction of the new European Commission, and if it will go toward “strategic autonomy,” with the EU at a “momentous moment.”

Europe and its “lack of political weight” internationally

Arancha González Laya, dean of the Paris School of International Affairs and former Minister of Foreign Affairs of Spain, expressed regret that the EU often has a “lack of political weight” internationally due to the differences between its members. “If we are not able to exert political influence in our neighborhood, what we are doing is increasing the risks for Europe,” she argued.

The course of the Spanish economy

The event’s last roundtable focused on “Economic outlook and policy,” especially in Spain. With Gonzalo de Cadenas-Santiago, Deputy General Manager at MAPFRE Economics, as moderator, the roundtable featured Iñigo Fernández de Mesa, Chairman of Rothschild Spain; José Manuel Amor, Managing Partner of AFI; Ángel de la Fuente, Executive Director of FEDEA (Foundation for Applied Economic Studies); and Gloria Hernández, Counselor at DIA and former Director General of the Public Treasury.

Ángel de la Fuente, from FEDEA, commented that demographic trends are complicating the sustainability of pensions, so the concern is “not so much that the system will go bankrupt, but rather the amount of resources that will need to be allocated,” to the detriment of other priorities.

Íñigo Fernández de Mesa asserted that fiscal pressure is already high in Spain, and that there is no room to raise it without harming economic activity. This reflected the opinion of Gloria Hernández, who stressed that companies are competing in a “very competitive” global environment, so Spain should focus on improving its productivity to create more opportunities.