ECONOMY| 12.01.2020

Impact of the crisis on Spanish insurance: two scenarios

As Physics Nobel Prize winner Niels Bohr put it, “Prediction is very difficult, especially about the future.” The inherent difficulty of making annual forecasts, such as those made around this time by analysis institutions and research centers, becomes particularly challenging in these times of Covid, in which the bases for predictions can turn completely on their heads in a matter of weeks.

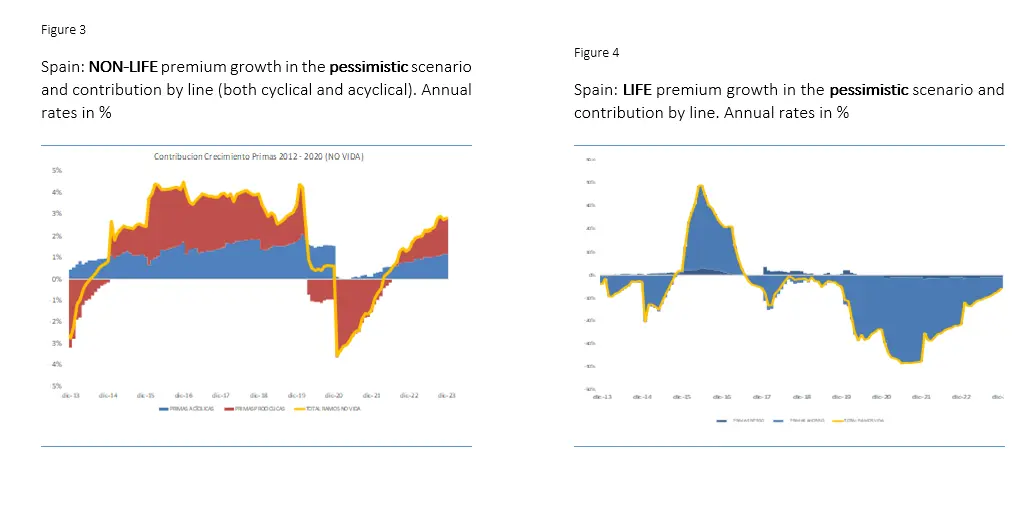

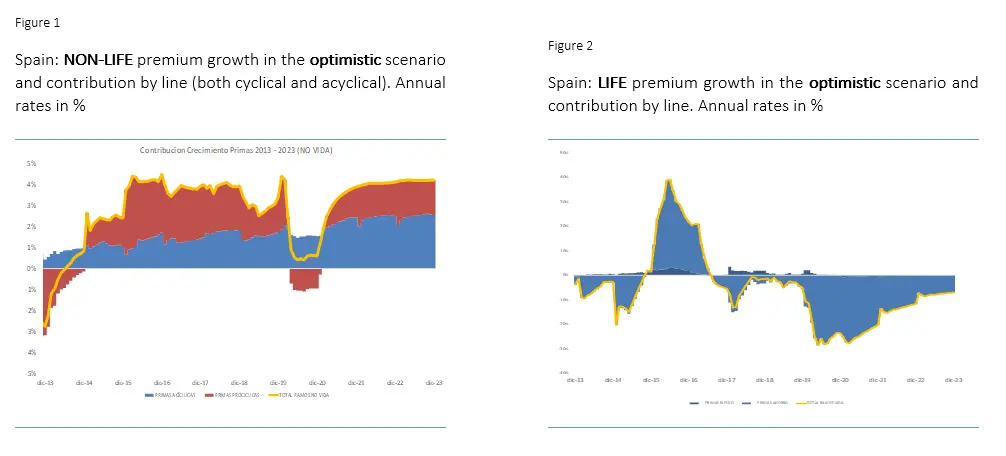

Even so, experts at MAPFRE Economics have ventured two possible scenarios for the Spanish insurance industry’s development over the next 12 months. They have envisaged both an optimistic and pessimistic scenario depending on the pandemic’s trajectory. These forecasts are based on variables related to activity (industrial production, tourism, etc.), financial variables (credit, savings, etc.) and expectations (both of consumers and producers), depending on the severity of social restrictions imposed in accordance with the pandemic’s developments.

The model developed by MAPFRE Economics takes into account all elements of the Non-Life (automobile, multirisk, health and other Non-Life) and Life business (savings and risk).

In the first, more optimistic scenario, a feeling of certainty returns and mobility restrictions are gradually lifted throughout 2021, whereas in the second scenario, this is not the case. Although MAPFRE Economics expects the first scenario to happen, it is not eliminating the possibility of the second. They are two complementary realities. Let’s take a look:

Optimistic scenario

From January 2021, this scenario shows a positive trend of greater certainty and a return to normal, culminating in restrictions being completely lifted. “This results in the Non-Life premium growth rate rapidly returning to close to what we consider as its long-term (between 3.5 and 4 percent), which takes place from the second quarter of 2021.” For the Life business, reduced uncertainty means people use financial savings (Life premiums) less and the contraction of this business gradually slows down.

Pessimistic scenario

If, however, the announcement and rollout of vaccines comes up against a new uncontrollable wave of infections, or if it is found that the vaccine can’t sufficiently control the pandemic, the scenario involving restrictions and uncertainty would continue. This would put even greater negative pressure on cyclical insurance demand in 2021 and would leave demand that doesn’t respond to the cycle at a standstill. This leads to a contraction of the Non-Life business in the current fiscal year, and then a relatively dynamic recovery (two years after the outbreak of the crisis, as a result of herd immunity) to achieve growth rates consistent with the long-term. In the Life business, the uncertainty and further qualitative expansion would lead to further insurance surrenders, further sinking the growth of this business.