INNOVATION | 16.07.2024

Insurtech funding in Latin America plummets to historic lows, reaching 26 million dollars in the first half of 2024

- Compared to the same period in 2023, there has been a 78% decline in investment. For the period between July 2023 and June 2024, inclusive, the total amount is $43 million, marking the lowest figure on record.

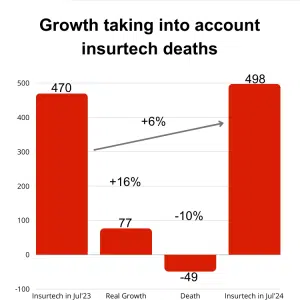

- The region now boasts 498 startups, reflecting 6% annual growth. The mortality rate was 10%, while organic growth is 16%, with 77 insurtech startups emerging or pivoting over the past 12 months.

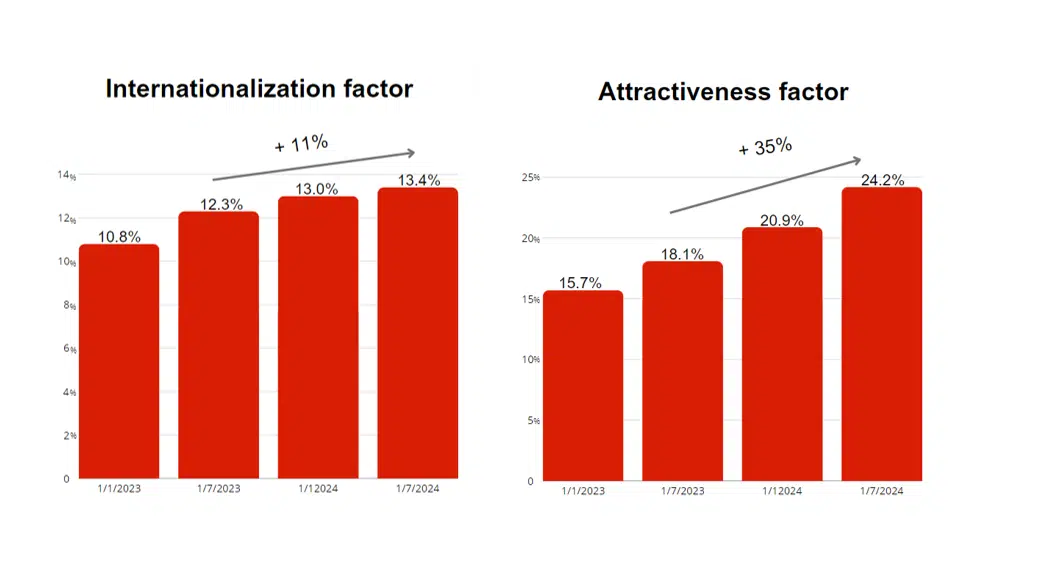

- International expansion has increased by 11%, with an internationalization index of 13.4%. Peru, Ecuador, Colombia, and Mexico lead Latin America in attracting foreign insurtech firms, with an attraction index of 24%.

- Within the insurtech ecosystem, 53% is focused on digital distribution, while 47% collaborates as enablers with (re)insurers and intermediaries.

Insurtech funding in Latin America reached $26 million during the first half of 2024, marking a steep 78% decline from the same period in 2023. Looking at the period from July 2023 to June 2024, inclusive, the total rose to $43 million, the lowest figure on record.

Despite this stark downturn in venture capital investment, the insurtech ecosystem in the region expanded by 6%, with a total of 498 startups. Considering a 10% mortality rate, organic growth reached over 16% in the past 12 months, with 77 new insurtech ventures.

These insights stem from the “Latam Insurtech Journey” report, compiled by Digital Insurance LATAM and sponsored by MAPFRE. This eighth edition of the document analyzes the state of the insurtech industry in Latin America.

Figure 1: Growth of the insurtech sector taking mortality into account. Source: Latam Insurtech Journey.

The ecosystem continues to grow despite a lack of investment

Breaking down the total number of startups in the region, Brazil leads with 203, followed by Chile (72) and Colombia (67). The Pacific region shows the highest percentage growth, notably Central America (69%), Ecuador (35%), Colombia (24%), and Peru (23%).

During the first half of 2024, international expansion grew by 11%, with a total internationalization index of 13.4%. Multilatina insurtech startups, operating in multiple countries, represent 13% of the market. Peru (42%) and Chile (30%) are driving this expansion due to their business scalability needs, while Brazil exports very few insurtechs (<1%) due to its unique market dynamics.

The attraction index for foreign companies is 24.2%, marking a 3.3-point increase from the beginning of the year when it was 20.9%. Analyzing the period from July 2023 to June 2024, inclusive, shows 35% growth (from 18.1% to 24.2%): on average, one in four insurtech startups in a given market is foreign.

Peru (63%), Ecuador (48%), Colombia (43%) and Mexico (31%) are the Latin American countries that draw the most foreign insurtech companies.

Figures 2 and 3: international expansion data (left) and sector attractiveness index (right) Source: Latam Insurtech Journey.

Mortality among insurtech startups declines in the region

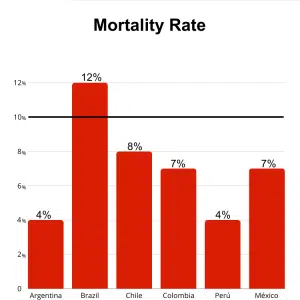

The annual mortality rate within the ecosystem stands at 10%, with 49 insurtechs closing over the past 12 months.

Of these closures, 92% were locally-based startups, underscoring the critical role of multilatinas in ensuring business survival. Proportionally, the distribution represents a higher percentage of failures, with a 67% mortality rate compared to enablers (33%).

Brazil bears the highest mortality burden at 12%, while Argentina and Colombia have shown notable improvements with rates of 4% and 7%, respectively, over the last year. It is also expected that some struggling entities, referred to as “zombies”, will disappear in the coming quarters.

Figure 4: Mortality rate by country. Source: Latam Insurtech Journey.

Enablers are growing, but distribution still prevails

Some 53% of insurtechs focus on distribution, marking a 6% decline from 2020. Despite this, distribution continues to dominate, though the ecosystem is increasingly exploring other business models.

Most distributors specialize in personal lines such as auto and home insurance, with Broker and Managing General Agent (MGA) models comprising 42%.

Enablers have seen a 6-percentage-point increase over the past four years, now making up 47% of the total within the Latin American insurtech ecosystem.

Notably, 18% of enablers offer solutions for digitalizing traditional intermediation. Additionally, 14% specialize in claims management solutions, and 6% focus on fraud detection.

Statements:

Hugues Bertin, CEO and Founder of Digital Insurance Latam, says that “the insurtech ecosystem in Latin America shows remarkable resilience. Despite limited funding, the mortality rate has dropped from 13% to 10%, with Argentina notably rebounding (+6%). I’ve never seen such enthusiasm in the countries to collaborate with insurtech startups. Initiatives like the Pacific Insurtech Alliance and other associations will continue to co-create the future of insurance, bridging both these innovative players and all traditional stakeholders, including major insurers in Latin America.”

Carlos Cendra, Scouting & Investment Lead at MAPFRE Open Innovation, says that “it speaks volumes about Latin American entrepreneurs that, despite limited investment, the ecosystem remains firmly committed to creating and fostering new startups to drive sector growth and narrow the insurance gap. Latin America is remarkably resilient and a highly attractive region for both local and international investors. We’ll closely monitor the coming months because if venture capital investment doesn’t increase, 2025 could pose significant challenges and a potentially high industry mortality rate.”