FINANCE | 12.28.2020

December 21st, started with headlines about the new strain of the COVID19, located initially in the UK, and able to extend contagions very quickly. Markets reacted in a very pessimistic way, but some hours later, this did not seem a permanent move. Instead, investors were driven by panic, as this happens when year-end is very close, so there is a threat of worsening significantly the final picture. Portfolios have had a very decent make-up in the last five weeks. Thus, the year so far seems much better than it actually was if you just look at markets.

The news about the new strain alone may not derail the optimistic trend in place since November. Such trend depends on three factors: huge liquidity, positive macro surprises and the assumption that the economic damage of the pandemic will be lower than expected from now on. Of this three, only the last one may be affected by the news. But there are still many questions around to doubt that headlines on the new strain will trigger a permanent shift in sentiment. Why now, if the strain is known since September? What politics has to do with the headlines and the subsequent measures? How will the economy react to new eventual lockdowns? There are so many unknowns that it is far too early to think of another rotation, although admittedly, investors have some doubts.

But even if the optimistic trend stays, it seems to me much more useful to think about the risks ahead, than about the trend itself, which is completely assumed by most market agents. So, in the following lines I will discuss which, for me, are the main risks on a short term horizon, say the next 3-6 months. Assigned probabilities are completely subjective.

Risks for the first half of 2021

The risks discussed below, as happens every time we think on such a short term, are threats to market sentiment. That is what moves asset prices in a 3 to 6 months horizon. So, the main focus of the discussion is the expected reaction of investors to each of them; not their long-term impact. This reaction depends completely on the narrative agents make on the issue, not the issue itself.

1.- The most obvious: pandemic

An increase in the rate of contagions or news about unexpected effects of the COVID (e.g. co-infections with flu, or different strains infecting at the same time…) may change the view investors have of the effects of the pandemic. What is important for asset prices is the economic effect. That is, the consequence of the actions governments will implement in order to tackle the problem. Or, to put it another way: it is commonly said that, to fight the pandemic, authorities can only improve two out of three conditions, while worsening the third: freedom, health and the economy. As long as they do not choose to harm the third, markets would probably not worry too much (although I’m not sure if that’s correct, but it is another issue).

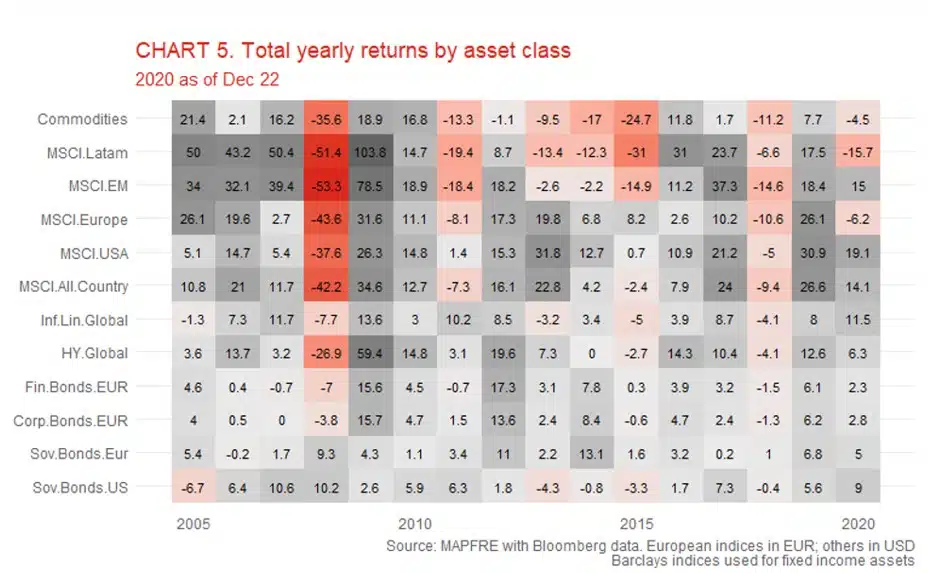

So far, the global rate of contagions seems to be slowing down (see Chart 1), although this can change any time. And specifically, there is a very high risk of a third wave and/or mutations after Christmas celebrations in western countries. Summing up, the probability of an increase in the contagions is (relatively) high, the probability of authorities choosing to harm the economy is low, and the probability of market sentiment turning down because of it is medium to low. Thus, I’d say probability of this risk is about 25%. The effect would be a classical flight to safe havens.

2.- Economic activity disappoints

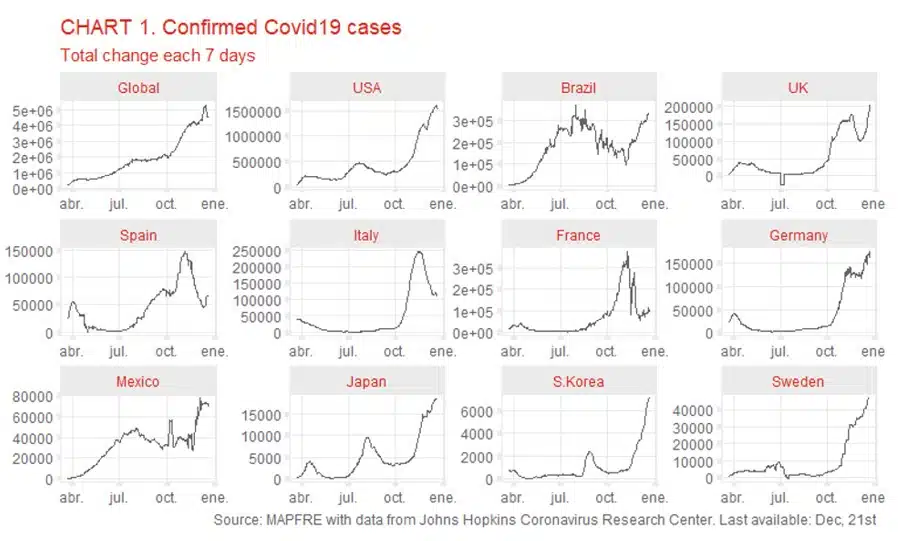

Macroeconomic surprises have been very positive for a long time now (see chart 2). When this happens, usually it is followed by a period of disappointment, because analyst readjust their expectations, and usually overshoot. In other words, analysts often go “behind the curve” of macro surprises. This could happen even if actual figures do not worsen, especially as the central scenario for most investors is growth to accelerate strongly in the first half of 2021, given the combination of fiscal and monetary stimulus, vaccines and end of lockdowns. Risk #1 cited above could be a trigger for this one, and it would reinforce its effect.

Probability of readjusting expectations is high, at least as we walk into the first quarter of 2021 with no significant increase in growth or corporate profits. I’d say 35-40%. This would lead to a temporary halt in stock prices, and probably, limited gains in US and EUR Treasuries. But the probability of risks #1 and #2 combined to devastate market sentiment seems much lower, I’d say 10%.

3.- Inflation (in Europe too!)

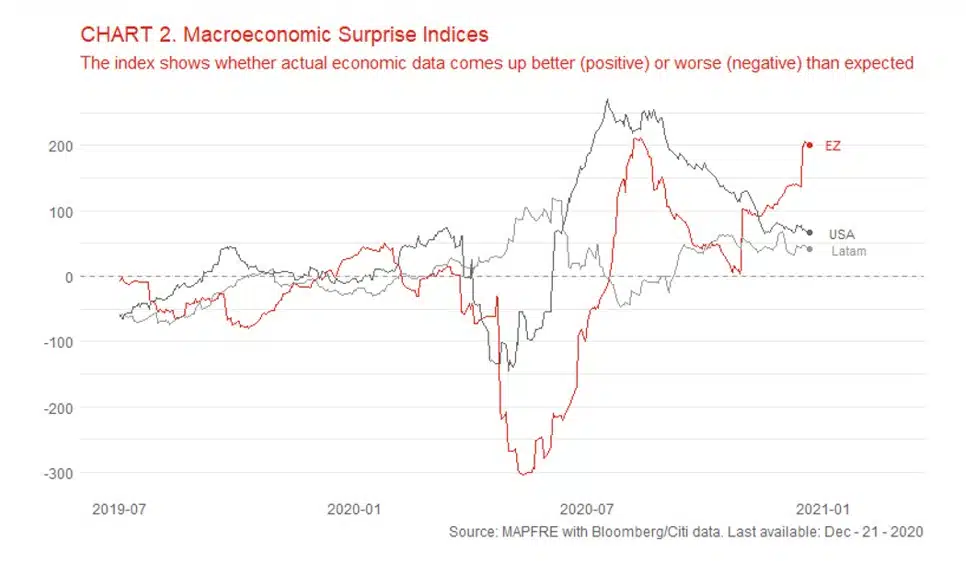

Inflation is a risk both sides of the Atlantic, and we have discussed it many times. But it is mainly a long-term issue with little implications for the next two quarters. The thing is that in the first half of 2021 CPI rates are set to raise because of several factors. The main one is the base effect: in Q1 and Q2 2020, prices were depressed due to lockdowns. Just by comparison, CPI yoy rates will grow significantly both in the US and the EZ. At the same time, the huge support governments have given to companies in many countries allows them to survive a protracted period with low sales1. This way, while this support is still working, firms may try to raise prices/margins since they know they will not face an immediate survival threat, which in turn may lead to higher CPIs. In other words, to some extent, support to avoid bankruptcies give companies a market power that would not exist in a purely competitive environment. There are other factors in place, like crude oil price, monetary transmission, or the recovery itself. All in all, this leads to higher CPIs in the first half of 2021.

The effect on asset prices is not completely clear, since it depends very much on how investors AND central banks read such data. Central bankers may get nervous and make some communication mistake; or investors may not consider the raise in CPIs temporary given the huge liquidity in the system. Or, there is a real risk that it becomes permanent. Since this risk may materialize through several different ways, I think its probability is not low, say 25%. It would cause volatility, curves steepening and divergence in stocks, depending on the perceived ability of companies to keep up with prices. Commodities and real assets would see significant gains.

4.- Liquidity restriction / USD strength

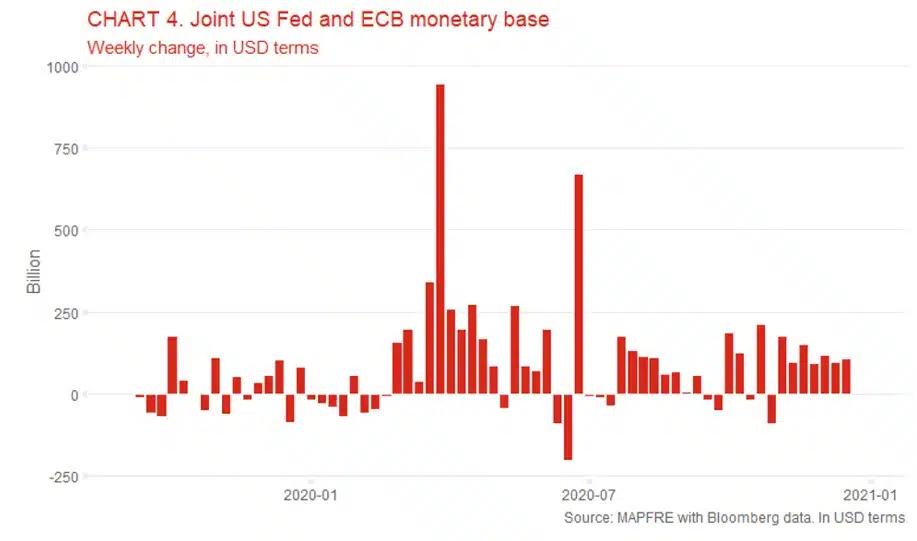

Huge liquidity provision is by far the main factor supporting markets this year. The joint balance sheet (basic amount of money) of the US Fed and the ECB raised by more than 50% in 2020. This is a historical experiment with unknown consequences in the future. As investors grow accustomed to this permanent inflow of new money, it is more difficult for them to imagine living in a world without it. Central banks have assured us they will not stop pumping for a long time, even if inflation raises. So, if they stop, that would be because of a policy mistake as we discussed in risk #3. But another problem can be an unexpected turn in exchange rates.

In the last two months, money inflow has been very regular (see chart 4), of more than $150 Bn per week, if we sum up the main central banks. We usually do not discuss the technical details of this fact in these documents because they are, well, too technical, for the investors who are focused on other issues. But when you dig deeper you notice that more than 40% of that inflow is due to USD weakness. As the USD is the de facto world currency, any investor whose home currency is different will experiment a boost of liquidity when the USD depreciates: for the same amount of, say Euros, he will have more dollars to use around the world. Another way of looking at the same fact is that any agent with liabilities in USD (many around the world), will experiment a relative debt relieve when the dollar falls. Anyway, the depreciation of the dollar implies a huge amount of liquidity by itself, that is, ADDED to the fact that many more dollars are being printed.

If, because of any reason, the greenback turns up again, this would imply a liquidity drain worldwide. Moreover, if this happens, it could be as a result of any of the above risks, with the USD standing as a shelter against falling asset prices. In this case, the negative effect could be multiplied. So, the effect would be large and reach every asset price, with the safest govvies being probably the only haven. But, for this to happen, the movement of the USD should be very sharp. A mild shift would be bearable. That’s why I think the probability of this event is not high, say 15%.

5.- Events in January

January is usually a busy month por portfolio managers. Many things happen, so this is not a particular risk, but the expectation of volatility during the next month. Particularly, there are two issues that may contribute to reshape market sentiment. The first is US politics. Among other things, the president elect must still be confirmed, or some concern may raise about fiscal stimulus if the presidential administration does not hold Senate control too. Although total gridlock is very unlikely, market sentiment could suffer. And this is not the only issue; for example, in Europe there is a (remote) risk of fiscal mutualization failing, in the Middle East the delicate balance of power may change abruptly with a different administration arrives at the White House, or, in general, a month when most investors readjust their positions is particularly fragile. In this sense, I’d define this risk as an event that changes the market narrative enough to interrupt the current optimistic trend. I’d say its probability is not low, since it comprises a combination of many things: 20%

Conclusion

Having such a clear trend in the last two months, and an overwhelming consensus for the next few, it seems to me much more important to think about risks. Above, I have written the five I think are the most dangerous, because of their expected outcome; that is likelihood and impact combined.

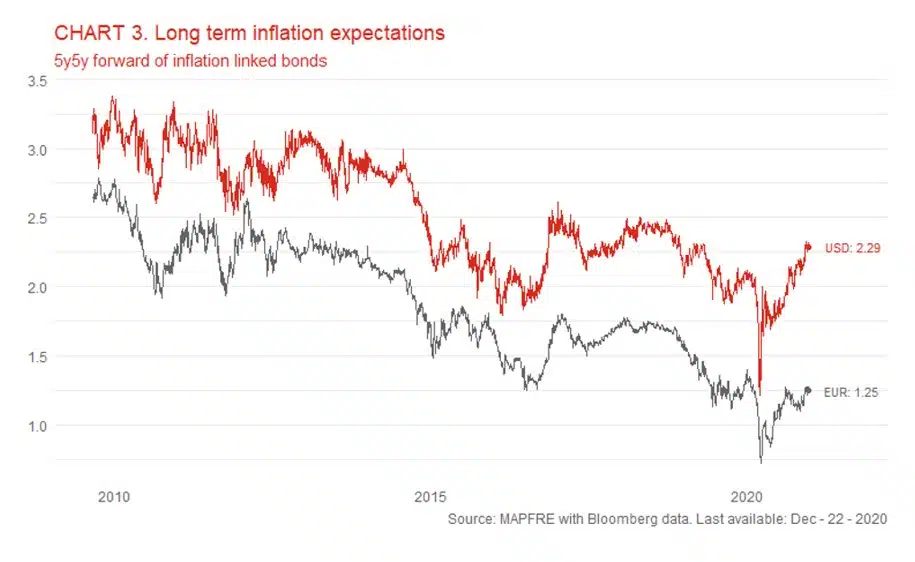

Their individual probability is low enough not to be part of a central scenario. This is quite positive. But risks are many; that means that the probability of “something” happening is enough for some concern. On the other side, however, the flood of liquidity is a powerful factor too. So, summing up, an event enough to cause a dramatic fall down is not likely at all. But we cannot rule out a reshape of the market narrative that has been in place for nearly two months now. Enough to make 2020 look decent at least (see Chart 5).