CORPORATE | 07.29.2020

Technical profitability of MAPFRE insurance business improves

The company’s half-year results, published on July 24, have highlighted the impact of the economic crisis caused by COVID-19 on MAPFRE’s accounts, with a 12.3 percent fall in premiums and a 27.7 percent decrease in attributable profit. The situation is similar for nearly all companies publishing results at this time.

And yet hidden within the data lies a substantial improvement in the technical profitability of the company’s insurance business. In the insurance world, said profitability is measured by the combined ratio, an indicator that is the sum of a company’s loss experience and expense ratio. A combined ratio of 100 percent means that every euro that clients pay to the insurer for policies is used entirely to pay indemnification and to cover the company’s operating costs — in other words, there is no profitability.

When interest rates were higher, many companies could afford to operate at combined ratios of above 100 percent, offsetting the lack of technical profitability with financial income returns. With low or even negative interest rates at present, those companies with no technical profitability in the business face a more precarious situation.

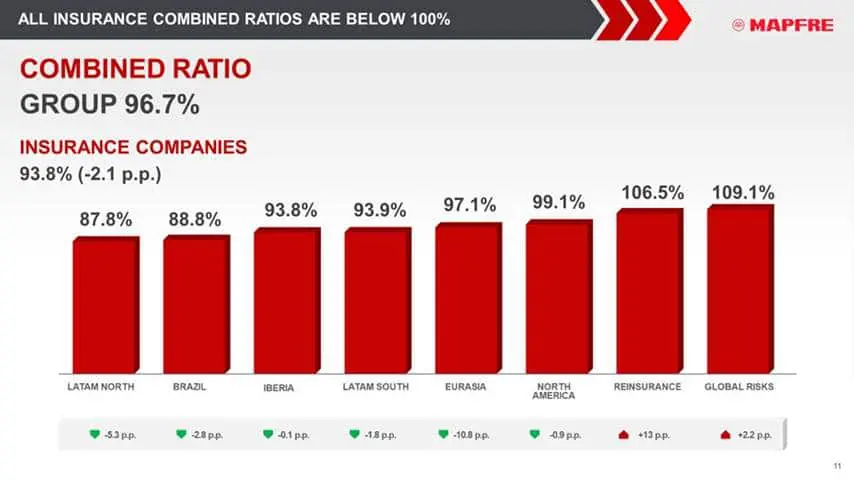

The combined ratio for the entire MAPFRE group currently stands at 96.7 percent. In recent years, Spain—where combined ratios are lower than that—has been at the forefront of technical rigor for insurance. However, this coincided with other regional areas—where the business maturity level was lower—that still had ratios above 100 percent. That is why it is so significant that in the data submitted up to June, MAPFRE is exhibiting a combined ratio of below 100 percent in all its insurance companies for the first time.

The combined ratio for insurance companies is even lower, at 93.8 percent. The reason that this jumps to 96.7 percent for the whole group can be explained by the impact of COVID-19 and catastrophic events on reinsurance and on Global Risks.

Evidently, this marked improvement in technical profitability includes certain circumstantial elements, such as the decreased loss experience in some lines as a result of the lockdown caused by the pandemic. But there are other structural factors linked to the profitable growth strategy that the company has been implementing in recent years. This can also be seen in the substantial increase in profitability in some strategic markets for MAPFRE, such as Brazil and the US.

In addition to the 221 million euros of net profit contributed by the Iberia region (Spain and Portugal), which represents the group’s traditional backbone in terms of results, a further 66 million euros was contributed in the USA and 60 million euros in Brazil. By comparison, Brazil earned 49 million last year and 30 million the year before that. In the US, the 66 million profit is in stark contrast to the 35 million in 2019 and 2 million in losses in 2018.

Latin America as a whole has also experienced a significant increase in profitability. The LATAM North regional area, for example, has almost doubled its profit in two years, from 24 million euros to 44 million euros, and has an ROE of 17.8 percent. The profits in LATAM South, meanwhile, increased by 6 percent compared to last year, up to 27 million, with a combined ratio of 93.9 percent.

The current outlook remains complicated, tarnished by the economic consequences of the pandemic, but in the meantime, MAPFRE will continue to do its homework and strive to reinforce operational efficiency in all the regions in which it operates. As Fernando Mata, MAPFRE CFO, explained during the presentation of results, “the impact of COVID-19 may well affect the speed of our trajectory, but it does not alter our course.”