CORPORATE|09.24.2024

MAPFRE solidifies its position as the world’s largest Spanish insurance Group

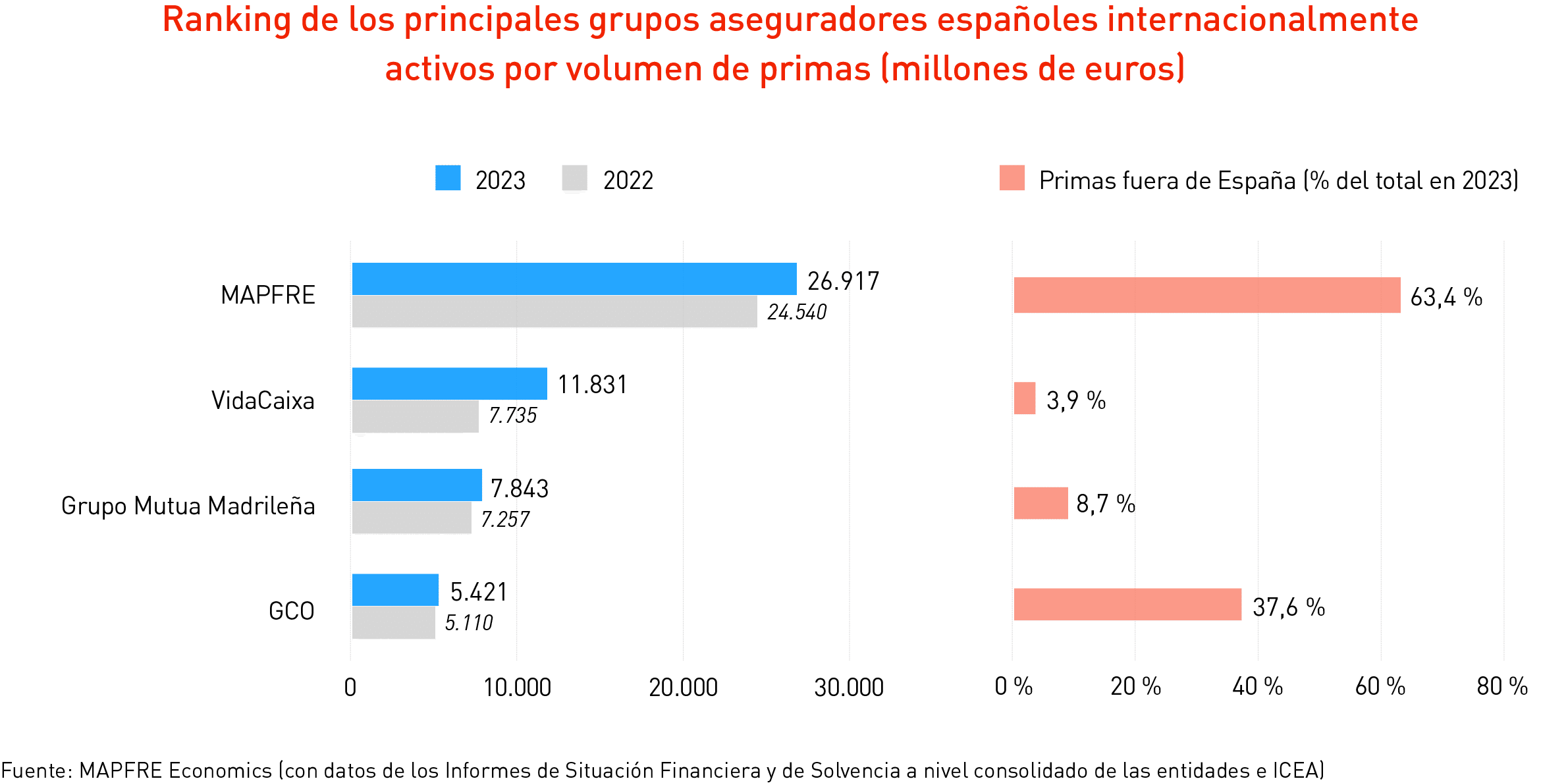

- MAPFRE Group’s premiums outside Spain accounted for 63.4% of the Group’s total premiums in 2023.

- Insurance demand in Spain rose by 17.8% thanks to strong economic growth, the interest rate environment, and easing inflation.

- Economic outlooks indicate that Non-Life premiums will continue to grow this year, while there may be a decline in Life premiums.

MAPFRE Group remains the top Spanish insurance group worldwide, with premiums of 26.912 billion euros in 2023, 9.7% more than the year before and 63.4% of which were generated outside of Spain. With the Non-Life and Life segments increasing by 8.4% and 14.6%, respectively, this growth in premiums is an indicator of better business overall, as MAPFRE Economics highlights in its report, “The Spanish Insurance Market in 2023,” prepared by Fundación MAPFRE.

The Spanish insurance industry’s performance in 2023 was shaped by strong economic growth driven by private consumption, interest rates hitting their highest levels in a decade, and a slowdown in price increases. All of this contributed to a 17.8% rise in total insurance premiums, reaching 76.36 billion euros, driven largely by the growth in Life insurance.

Life insurance premiums also surged by 36%, reaching 33.36 billion euros in 2023, while Life-Savings insurance, which rose by 46.3%, was the primary driver of growth in the Spanish insurance industry. Meanwhile, Non-Life insurance premiums increased by 6.8% to 43 billion euros.

MAPFRE Economics emphasized that the Spanish insurance industry’s stellar performance in 2023, marked by record growth, helped boost insurance penetration in the economy. As a result, the ratio of premiums to GDP rose from 4.81% in 2022 to 5.22% in 2023 thanks to the increase in Life insurance penetration.

The figures for the first quarter of 2024 indicate a shift in trend. Non-Life segment premiums grew by 7.8% compared to the first quarter of 2023, while Life premiums fell by 14.1%. As a result, the total annual change in premium volume through June is projected to be a decrease of 2.2%. Based on this data, it’s expected that by the end of 2024 (and depending on the behavior of the price index), the real performance of both segments of the insurance business will follow a similar path.

Spending per Spanish person on insurance

The report includes a detailed analysis of structural insurance trends, in other words, penetration, density, and depth. Density in Spain (premiums per capita) reached 1,571.5 euros in 2023, an increase of 223.8 euros over the previous year. While both market segments experienced growth, the increase in Life insurance stands out, with density rising by 176 euros to reach 686.5 euros. Meanwhile, Non-Life insurance density stood at 885 euros, an increase of 47.5 euros over the year before.

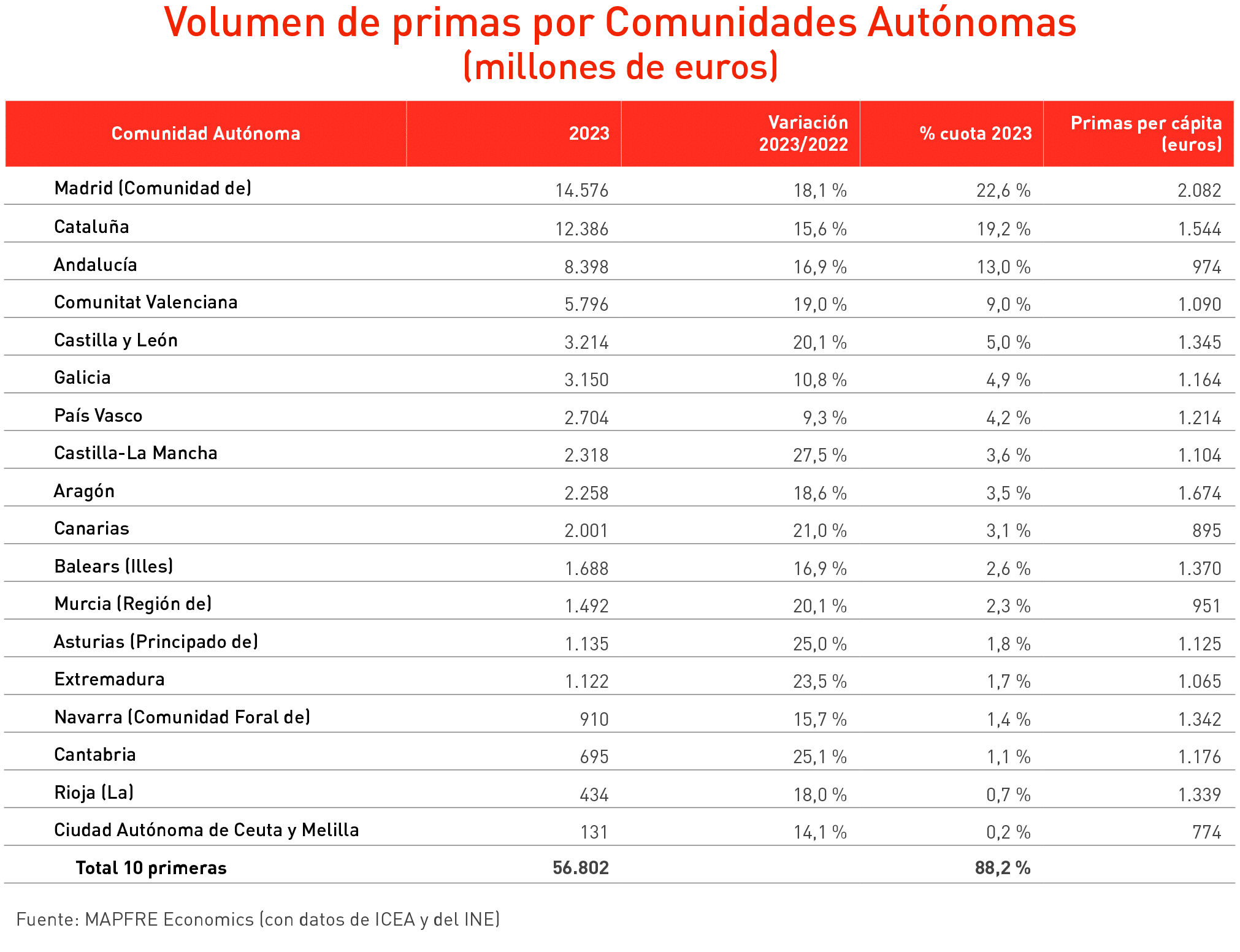

All the autonomous communities saw double-digit premium growth, except for the Basque Country, which grew by 9.3%. The growth in Castilla-La Mancha was particularly noteworthy with 27.5%, followed by Cantabria with 25.1%, and Asturias with 25%.

Madrid’s residents spend the most on insurance in Spain, 2,082 euros a year, followed by Aragon and Cataluña, 1,674 and 1,544 euros, respectively.

To read the full report, click here