CORPORATE|09.11.2023

MAPFRE moves up to 9th place in ranking of Europe’s largest insurance companies

- The insurance company’s ranking has risen for the second year in a row, with its premiums increasing by 10.8% in 2022 to reach €24.540 billion

- Only five insurance groups, including MAPFRE, reported double-digit increases in their total premiums

- In 2022, total premium income for the 15 largest European insurance groups was €618.712 billion, representing an increase of 7.7%

The MAPFRE Group has moved up in the 2022 ranking of Europe’s largest insurance groups, according to a report prepared by MAPFRE Economics and published by Fundación MAPFRE. In the previous year’s report, MAPFRE appeared in the top 10 for the first time, and now the company has moved into 9th place for 2022, after its premiums increased by 10.8% to reach €24.540 billion, despite the complex macroeconomic and geopolitical context. As explained in the report by experts from MAPFRE Economic Research, “this increase reflects a generalized improvement for the insurance industry in practically all regions where it operates, with significant increases seen in Latin America and North America, as well as in the reinsurer and large risks lines of business. It also reflects the favorable performance of almost all currencies compared to the euro.”

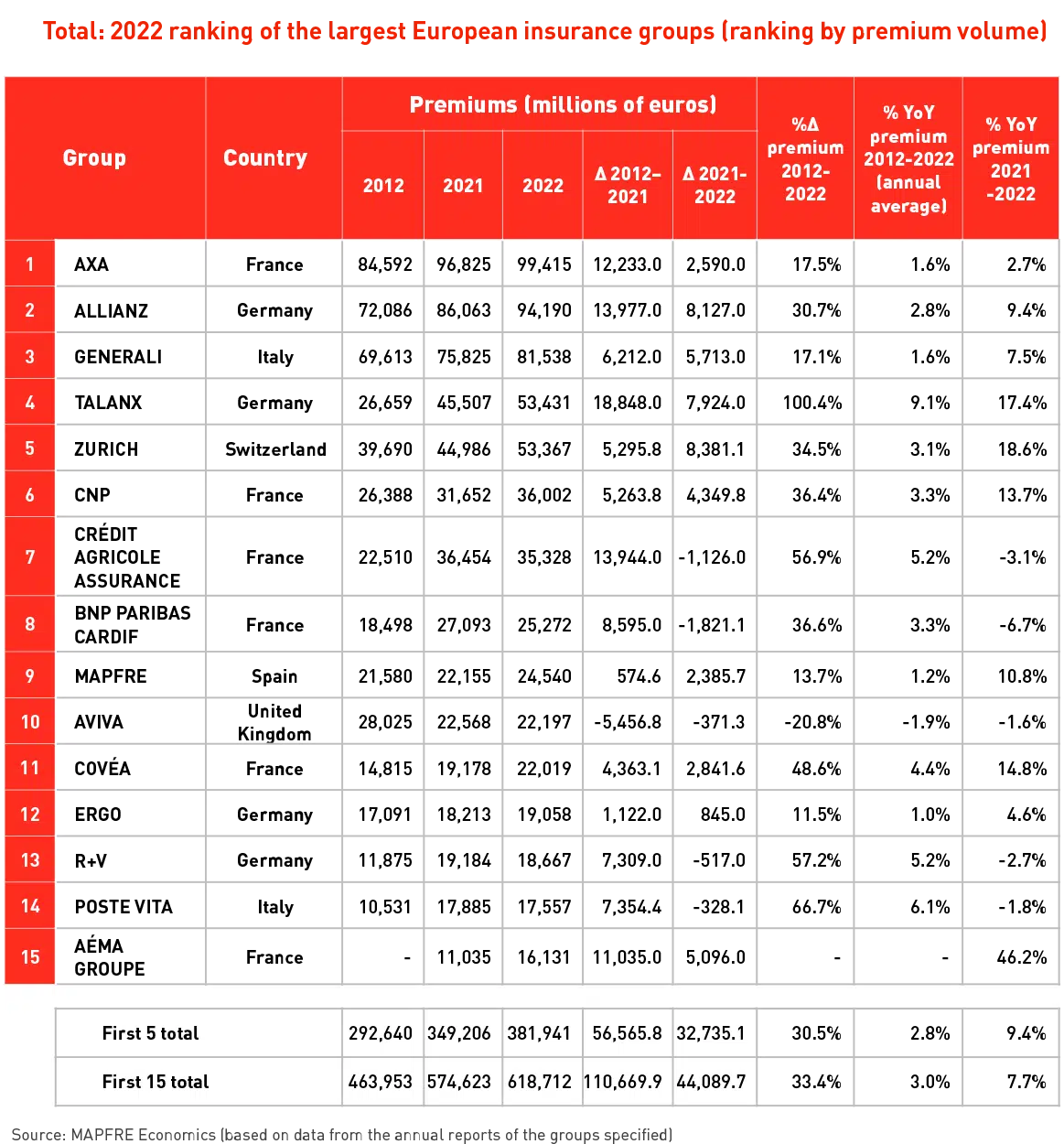

In general, the performance of the insurance industry in Europe was positive, despite the existence of a challenging environment. As evidence of this, premium income increased by 7.7% in 2022 for the top 15 European insurance groups included in the ranking. Total premium income for those groups reached €618.712 billion, with double-digit increases seen in the case of France’s Aéma Groupe (46.2%), which initiated its operations in 2021 following changes in the consolidation scope after the Abeille Assurances subgroup had been included for a complete year, Zurich (18.6%), Talanx (17.4%), Covéa (14.8%), CNP (13.7%), and MAPFRE (10.8%):

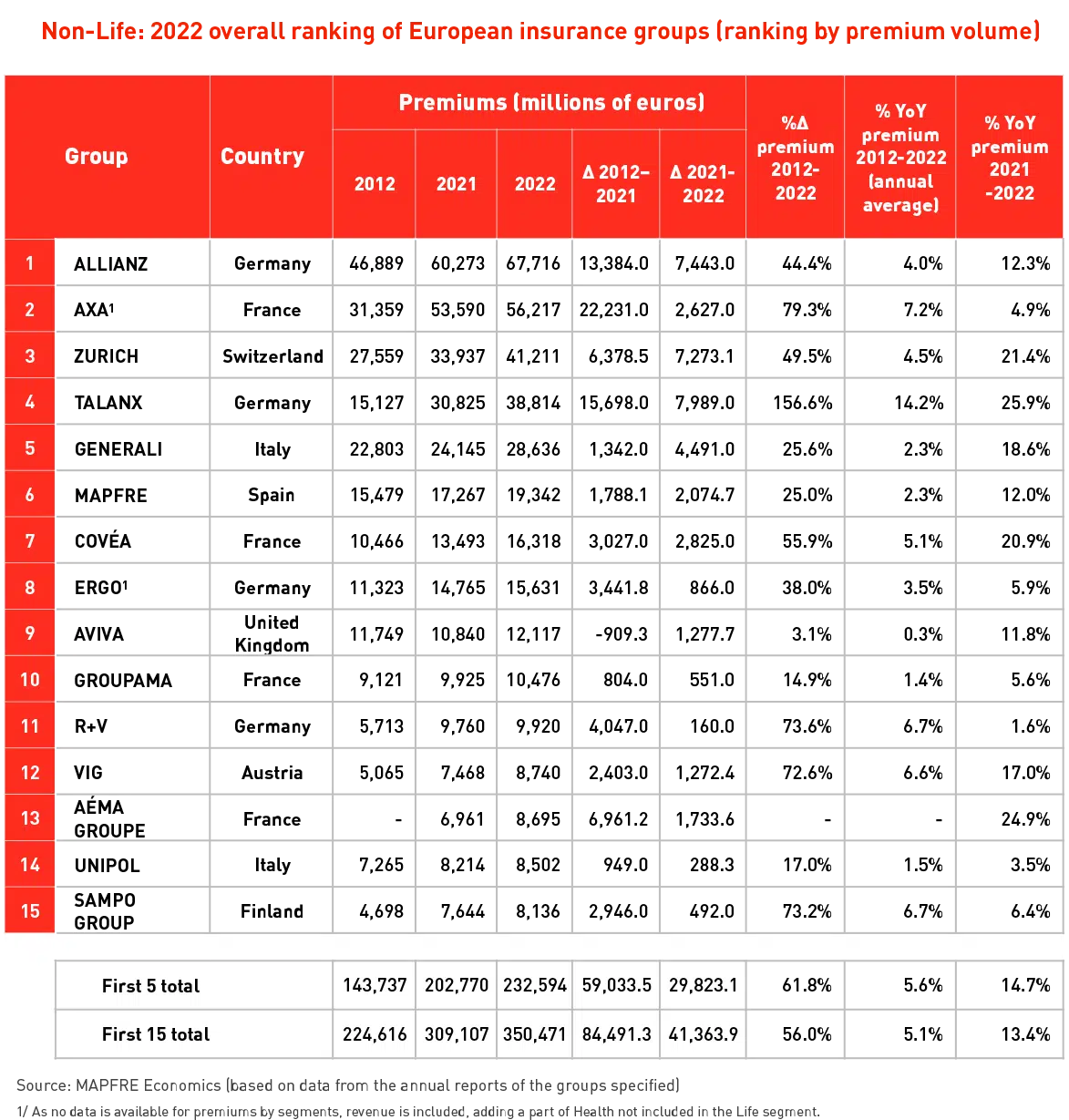

The Life segment was negatively affected by the impact of the war in Ukraine and high levels of volatility in the financial markets, among other factors. In that line of business, the 15 largest insurance groups recorded a slight decrease of -0.1% in their premium income, while a 13.4% increase was seen in the Non Life segment.

Specifically, the 15 groups included in the Non Life ranking reported €350.471 billion in premium income, representing a 13.4% increase compared to the previous year. For 2022, the MAPFRE Group remained in 6th place in the European Non Life ranking, with €19.342 billion in premium volume, representing a year-on-year increase of 12.0%:

In addition, the effects of inflation, high loss experience from natural disasters, and volatility in the financial markets as mentioned above, are all factors that have led to a decrease in results (down by -9.6% compared to 2021), and to a negative impact in general on the combined ratio of the insurance groups in the Non Life line of business.

Click here to read the full report.