CORPORATE|09.10.2024

MAPFRE is the leading multinational insurance group in Latin America

- With premiums totaling $10.559 billion and a 5.2% market share, the insurer is the leading multinational insurance group in Latin America.

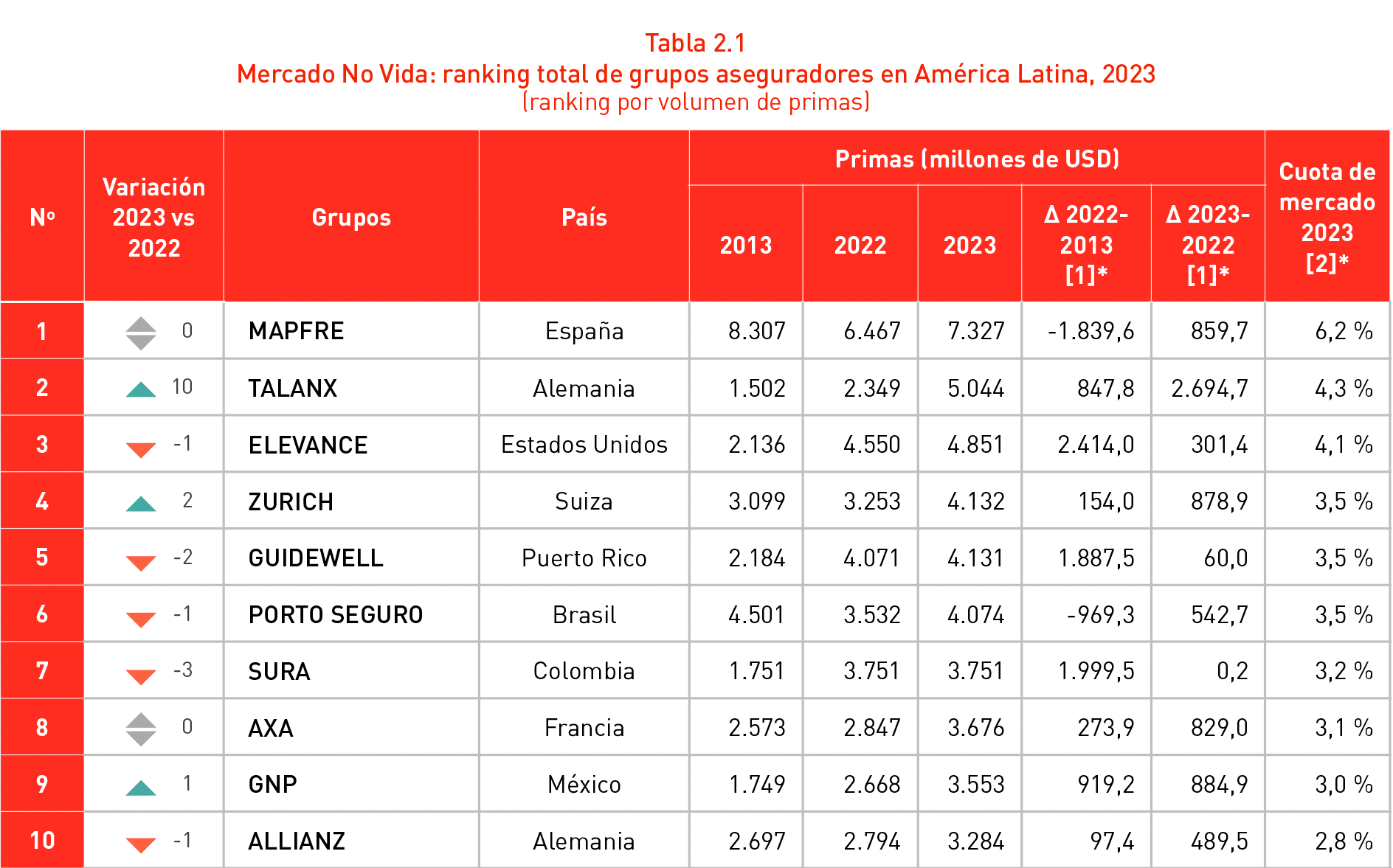

- MAPFRE remains the top player in the Non-Life insurance sector in the region, with premiums reaching $7.327 billion and a 6.2% market share.

- The top 25 insurance groups in Latin America generated $126.950 billion in 2023, an increase of 19.38%.

The MAPFRE Group is the leading multinational insurance provider in Latin America, with premiums totaling $10.559 billion in 2023, up from $9.229 billion the previous year, and holding a 5.2% market share. This is highlighted in the “2023 Ranking of Insurance Groups in Latin America”, prepared by MAPFRE Economics and published by Fundación MAPFRE. The ranking is topped by Brazil’s two largest insurance groups, Bradesco and Brasilprev, which operate exclusively in their home country.

Insurance companies in Latin America saw a 17.1% increase in subscribed premiums in 2023, with strong performance in Brazil, Mexico, and Argentina. The top 25 insurance groups in the region generated a total of $126.950 billion, marking a 19.38% rise compared to the previous year. Among just the top 10 groups, the annual growth rate was 17.24%.

Overall, the Latin American insurance market recorded $203.354 billion in total premiums, up from $173.675 billion in 2022. By line of business, Non-Life insurance premiums rose to $117.336 billion (a 17.07% increase), while Life insurance premiums grew to $86.018 billion (up 17.1%).

“This positive performance is attributed to balanced growth in both Life and Non-Life lines of business, each experiencing a 17.1% increase and contributing equally to overall growth. Notably, in terms of impact on the region’s insurance industry, Brazil saw a 13.1% improvement, Mexico experienced a 33% rise, and Argentina grew by 20.7%,” according to MAPFRE Economic Research.

In 2023, the Non-Life business represented 57.7% of premiums in the region, maintaining the same percentage as the previous year. The markets with the highest growth were Mexico, with a 34.4% increase; Costa Rica, with 24.4%; and Argentina, with 21.3%. Brazil, holding a 22.5% share of premiums; Mexico, with 21.1%; and Argentina, with 15.9% are the most significant markets in this branch. Among insurance groups, MAPFRE leads the Non-Life business with premiums of $7.327 billion (a 13.3% increase) and a 6.2% market share, surpassing competitors such as Germany’s Talanx and the U.S.’s Elevance.

At the close 2023, Life insurance business accounted for 42.3% of the total insurance market. MAPFRE Economics notes significant growth in Mexico, Costa Rica, and Chile, with increases of 31.3%, 30.6%, and 28.9%, respectively. The majority of life insurance activity in the region, measured in dollars, is concentrated in three countries: Brazil, which holds 48.8% of the market; Mexico, with 23%; and Chile, with a 10% share. Combined, these three markets contribute 81.9% of the branch’s growth in Latin America.

The “2023 Ranking of Insurance Groups in Latin America” by MAPFRE Economics also explores market concentration in the region from 2013 to 2023. The current situation shows low overall concentration in the market, with significant differences between the Life and Non-Life segments. This disparity reflects the industry’s evolution, with Life insurance developing more slowly compared to Non-Life insurance.

To read the full report, click here.