CORPORATE|07.30.2024

MAPFRE Economics forecasts that the world economy will grow 3% in 2024 and 2.9% in 2025

- Global growth continues to decelerate, although the gradual decline in inflation is a relief.

- The main risks include geopolitics, governance and economic policy.

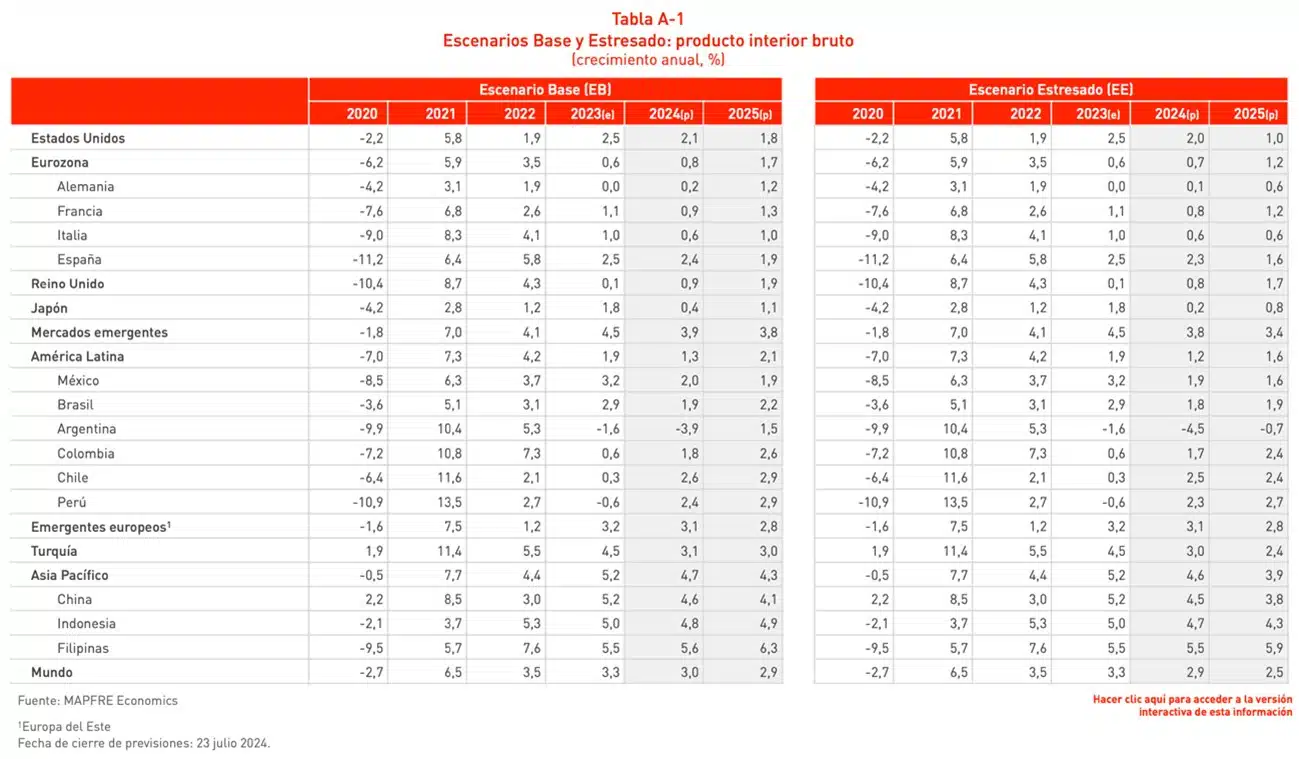

The world economy continues to decelerate, although it’s managing to maintain positive growth thanks to inflation rates that have been gradually declining in recent months. In this context, MAPFRE Economics, MAPFRE’s research arm, is anticipating growth of 3% in 2024 and 2.9% in 2025, both above the 2.6% previously forecasted for the two years. These are the predictions highlighted in the “Economic and Industry Outlook 2024: Outlook for the Second Semester,” report prepared by MAPFRE Economic Research and published by Fundación MAPFRE.

Inflation is continuing to move in the right direction, but it hasn’t yet reached the target, and is expected to be 4.5% and 3.5%, respectively. Among the obstacles, there are ongoing pressures from services and rising wages on the demand side, while on the supply side, other challenges are materializing, such as supply chain disruptions due to the Red Sea crisis and fluctuations in commodity prices. The particularities of each area, in turn, mean that the inflation outlook presents very different realities around the world and with very different stages of development.

In 2024, the balance of global risks is slightly skewed to the downside, with notable geopolitical, governance and economic policy risks, and the potential shift to a less favorable, though not recessionary, scenario.

By geographic area, the United States is projected to grow by 2.1% this year and 1.8% next year, maintaining the previous edition’s forecast for 2024 and raising the forecast for 2025 by two tenths of a percentage point. Inflation is expected to amount to 3% and 2.4%, respectively. MAPFRE Economic Research notes that the labor market is beginning to show signs of weakness, with unemployment rising to 4.1% in June from 3.8% in March, which adds to the negative leading indicators that have been emerging. The main risk to the U.S. economy is the high level of debt and deficit, especially at a time when the government should ideally be running surpluses given the healthy growth.

The Eurozone is expected to grow by 0.8% in 2024 and 1.7% in 2025, with inflation of 2.3% and 2%, respectively. The short-term performance of the European economy will depend to a large extent on the interplay between anticipated monetary easing and its impact on inflation, as well as the reintroduction of fiscal rules, i.e. fiscal tightening.

Asia Pacific, meanwhile, GDP is expected to grow by 4.7% this year and 4.3% next year, with inflation of 0.9% and 1.7%, respectively, while Latin America is projected to grow by 1.3% in 2024 and 2.1% in 2025. Inflation will stay high, closing the year at 8.5% and slowing next year to 7.6%.

“The current panorama offers a more balanced macroeconomic outlook, although this stage of slowdown continues to pose certain divergences in terms of activity, inflation and monetary policies, against a challenging geopolitical backdrop that is opening a deeper rift,” Manuel Aguilera, General Manager of MAPFRE Economics, highlights in the report.

Impact on the insurance industry

The outlook for the global insurance market in 2024 is positive, and although lower than in 2023, Life premiums are expected to grow by 4.4%, and Non-Life by 5.2%. These are consistent with the good performance the world economy is expected to show throughout the year.

For 2025, the expected cyclical situation may even improve, as more controlled inflation could lead to financial conditions that support both consumption and investment. This would result in relatively favorable projections for Non-Life premiums, with expected growth of 5.4%, and still favorable conditions for Life premiums, with an anticipated growth of around 7.9% year-on-year.

You can read the full report here