CORPORATE | 08.31.2020

How insurers can help fight social inequality

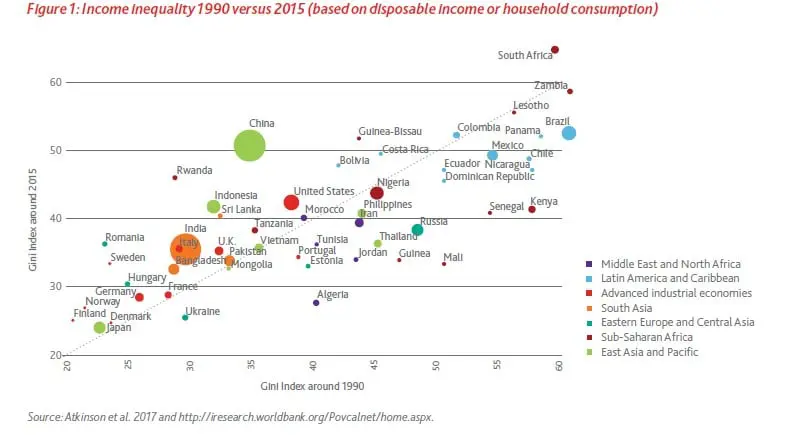

The pandemic is having an unprecedented social and economic impact. All public agencies as well as private firms predict a bleak outlook with a sharp decline in GDP that, in many cases, will exceed double digits. This new, unexpected shock is being felt particularly strongly in developing countries, further exasperating social inequality.

Given this situation, the Geneva Association, made up of the world’s leading insurers and reinsurers, has released a comprehensive report on the role these companies can play in addressing this challenge. The poorest communities are suffering a higher proportion of cases and deaths than the general population. According to the study, this is related to factors such as limited access to high-quality healthcare.

Developing countries do not have the necessary safety net to mitigate the impact of this type of event. People are exposed to a loss of wealth and income that affects their whole family and may condemn them to poverty. In addition, many jobs considered ‘essential’ are those with lower incomes for which remote working is generally not an option. Moreover, these countries, which already had weak budgets, are stretching their fiscal space to the limit. This is why there is growing support for inclusive insurance (aimed at groups who are generally excluded or underserved by the insurance market) as a tool for preventing and alleviating poverty.

The report, entitled The role of insurance in mitigating social inequality, outlines specific approaches and insurance products that can protect the middle classes and better serve vulnerable segments of society with a view to reducing social inequality. “At this momentous juncture for the world, we hope that insurers, policymakers, regulators and other stakeholders heed the recommendations made in this report,” the authors point out.

For insurers, one of the most important aspects of social inequality is its impact on the stability and resilience of economies and societies. At the macro-level, inequality affects an economy’s ability to comfortably develop along its path of potential growth and minimize losses of revenue and assets resulting from shocks. These effects lead to less stable and dynamic economic growth, greater vulnerability to financial crises, and the risk of social unrest and political violence. Thus, the report states, “it is in the insurance sector’s own interests to think about products and solutions that could help mitigate growing income and wealth inequality.” At the micro-level, inequality influences the ability of individuals, households and businesses to withstand shock events. It manifests itself in unequal access to protection from insurance or insufficient knowledge of insurance (for example, as a result of financial illiteracy).

In this scenario, the report recommends several different actions that insurers should take. For example, they should proactively engage with the public sector to examine additional approaches that would create such a social safety net. Now is the perfect time for this, given that governments are facing the issue of indebtedness and people are more aware of the value of life, health and projected income. Secondly, the insurance industry should innovate and come up with new products that break away from traditional ones for clients who are especially vulnerable to economic crises. Thirdly, insurers must leverage technology to improve insurance accessibility at a lower cost. And lastly, they must promote financial and insurance literacy. However, for all these measures to be effective, according to the study, governments and regulators must create a suitable regulatory framework to promote inclusive insurance.

Inclusive insurance ranges from microinsurance for the poorest communities to new products and services for those who are on the threshold of the middle classes and have not been sufficiently served by traditional insurance. It is specifically aimed at people who are generally excluded not only by ordinary commercial insurance but also by social insurance plans that cover formal sector employees.

Low-income households are particularly vulnerable to risks and economic crises. By helping these households manage risk, microinsurance can greatly contribute to the resilience of developing countries. The main risks covered by microinsurance include illness, accidents, disability, death, children’s education, loss of P&C, loan risk, crop risk and livestock risk. Climate risk greatly exacerbates exposure to some of these risks and has therefore led to the development of specific climate-related insurance products.

In this same vein, MAPFRE Economics recently published a report on Financial inclusion in insurance, which provides a conceptual and international analysis of how microinsurance can contribute to the objective of financial inclusion and to increasing opportunities for a very broad segment of society to have access to higher levels of well-being. As explained in this document, two factors have been influencing the development of microinsurance in recent years. “The first is the willingness of public authorities to stimulate its growth as part of the design of specifically created public policies; and the second is technology, which can facilitate access to a broad group of potential policyholders (even in rural areas) at a reasonable cost.”

Private insurance, while not designed to address social inequality per se, can therefore offer relief when certain events occur that cause households to lose income or the ability to earn income. These unexpected events hit the poor hardest, which has unfortunately been exemplified by the COVID-19 pandemic.

- To read the full report by the Geneva Association, click here

- To read MAPFRE Economics’ full report on financial inclusion, click here