MAPFRE’s net result reaches 744 million euros, growing 36% in the first nine months of the year

- To this result, a €90 million writedown of goodwill in Verti Germany was applied, bringing the attributable earnings to €654 million (+39%).

The strong growth in the result is driven by improvements in technical management in all regions and business units.

The positive business performance allows us to raise the interim dividend to 6.5 cents gross per share (+8% more than the previous year).

The adjusted ROE increases to 12% and shareholders’ equity grows 4.5% to over €8.4 billion.

Premiums are up 4.6% (6.1% at constant exchange rates), reaching over €21.6 billion, with advances in all lines of business.

The improvement in Non-Life continues, with a 94.8% combined ratio (-2.0 p.p.) and a relevant contribution from the recurring financial result.

IBERIA’s result grows 15% to €283 million.

NORTH AMERICA posts a relevant increase in results (+€89.4 million), consolidating the technical improvements implemented.

LATAM, which includes BRAZIL, continues to be the highest contributor to Group profit with €305 million (+7.7%).

MAPFRE RE, which includes the reinsurance and global risks businesses, posts solid results of €207 million (+9.3%).

“The figures for the third quarter confirm the positive trends driven by the new Strategic Plan. The increase in the dividend reflects our confidence in the future and our commitment to shareholders. Additionally, we have strengthened our balance sheet even more in an exercise of prudence, maintaining the growth in our capital base,” says Antonio Huertas, Chairman and CEO of MAPFRE.

MAPFRE S.A. hereby informs that the figures and ratios in this activity report are presented under the accounting principles in force in each country, homogenized for comparison and aggregation between units and regions. As such, certain adjustments have been applied, the most relevant of which are the following: the elimination of the goodwill amortization in Spain and the elimination of catastrophic reserves in some Latin American countries. In Malta and Portugal, the applicable local accounting is IFRS 17 & 9. MAPFRE Group presents its financial statements under the international accounting standards in force (IFRS 9 and 17) applicable to listed companies on a half-year basis.

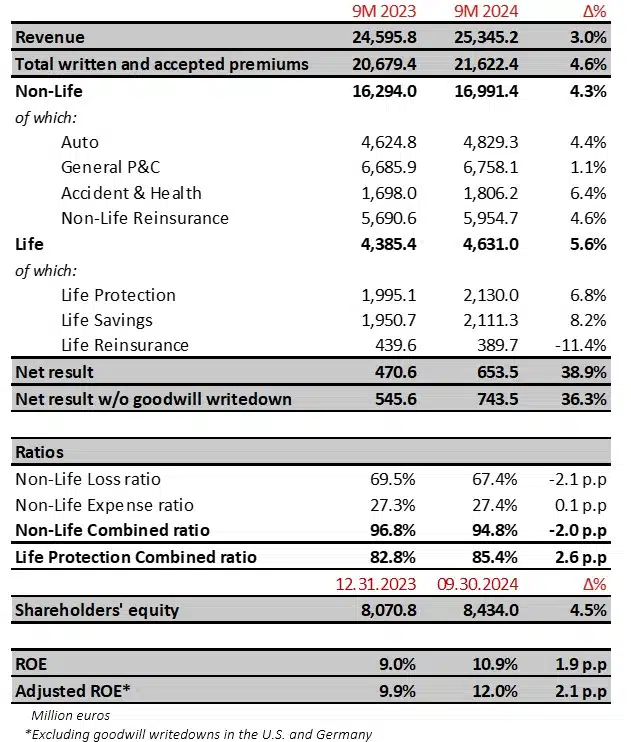

1. KEY FIGURES

- Premiums are up 4.6%, supported by the Non-Life tariff updates and by the positive performance of the Life business. In Non-Life lines, there is noteworthy performance in the Accident & Health line (+6.4%) and a significant improvement in Auto (+4.4%). The General P&C business is up less (+1.1%) due to the slowdown of the Agro business in Brazil and the depreciation of the real. In Life Savings, premiums are up 8.2%, supported by the business in IBERIA and OTHER LATAM. Life Protection is up 6.8% with notable growth in Mexico and Spain. By market, IBERIA, LATAM and reinsurance continue performing positively. At constant exchange rates, premiums are up 6.1%, with Non-Life and Life up 5.7% and 7.3% respectively.

- The net result, which stands at €654 million, is up 39%, based on the following developments:

a) The relevant improvement in Non-Life technical profitability from both underwriting measures and tariff adjustments.

b) The relevant contribution of the Non-Life financial result, which reached €576 million (€567 million the previous year), before the goodwill writedowns, supported by portfolio yields.

c) The large contribution of the Life business, both Savings and Protection, especially in LATAM and IBERIA. The Life Protection combined ratio continues at an excellent level (85.4%), slightly up due to an increase in acquisition expenses in the business in Brazil.

d) Following prudent criteria, at September, the Group recorded a €90 million provisional impact for the goodwill writedown in Verti Germany, based on the current context of the Auto market in this country. This estimate will be updated at year-end according to interest rates and business plans. In 2023, a €75 million goodwill writedown in the United States was recorded.

e) The recognition of extraordinary income (€35 million), from various tax adjustments, most of which resulting from the declaration of partial unconstitutionality of Royal Decree-Law 3/2016. In 2023, €46.5 million in extraordinary income was recorded from the arbitration of the end of the Bankia alliance.

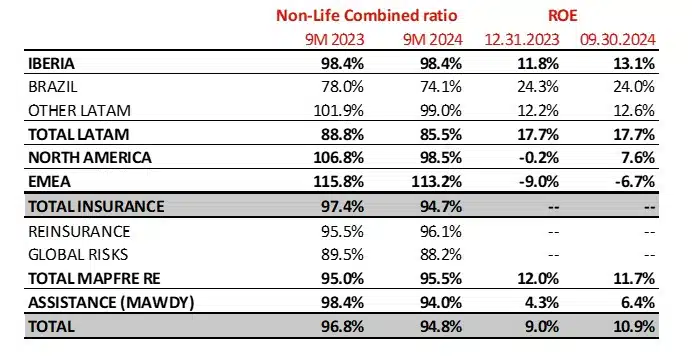

- The Non-Life combined ratio improves 2 p.p. to 94.8% supported by tariff adjustments and a more benign weather and catastrophic context than 2023, which had a more than €100 million impact from the earthquake in Turkey. General P&C reaches an excellent 81.1%, (-6.0 p.p.), with exceptional improvements in IBERIA, BRAZIL and NORTH AMERICA. The Auto combined ratio improves 1.7 p.p. to 104.2%, with strong reductions in NORTH AMERICA, BRAZIL and OTHER LATAM, while the recovery process in IBERIA is more gradual, with a relevant improvement in the quarter. The Auto combined ratio is currently below 100% in many markets. The Accident & Health combined ratio stands at 99.8%.

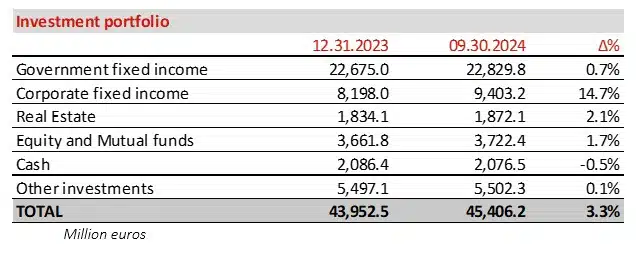

- Shareholders’ equity is up 4.5%, reaching over €8.4 billion, from the result contribution. The €194 million improvement in net unrealized gains and losses on the investment portfolio offset the negative currency conversion differences which stand at €193 million.

- Net realized gains have had a €35.1 million impact on results (€22.3 million in 2023).

- The investment portfolio is shown below:

- The MAPFRE Group Solvency II ratio stands at 196.6% at June 2024, compared to 199.6% at the close of December 2023, stable and within the established target range.

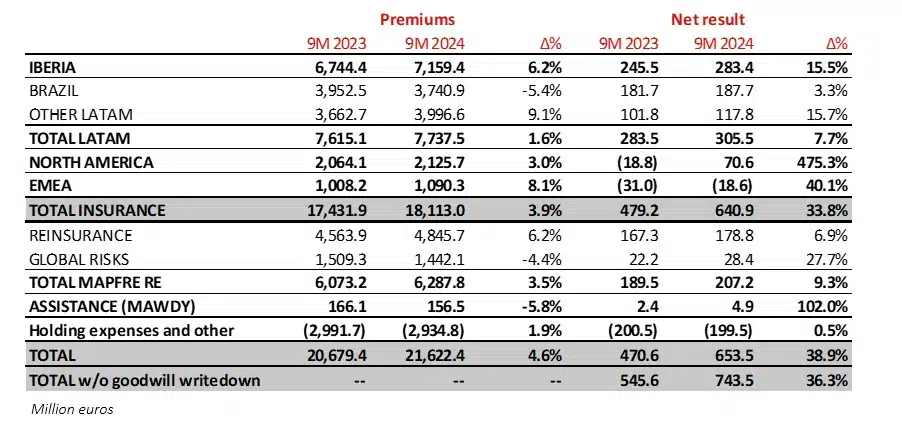

2. INFORMATION BY REGION AND BUSINESS UNIT

IBERIA’s result grows more than 15%, maintaining its solid leading position in the main lines of business

- Premiums in IBERIA reach nearly €7.2 billion (+6.2%), with Spain standing out with over €6.8 billion (+4.8%). Premiums in Portugal are up 43% driven by the strong growth in Life Savings.

- Non-Life premiums are up 6.3% and reflect the positive development of General P&C (+6.6%), especially in the Homeowners and Condominium lines, and Accident & Health (+6.8%). In Auto, premiums are up 5.9%.

- The Non-Life result and combined ratio are affected by the Auto business, which is impacted by an increase in bodily injury costs. The combined ratio stands at 104.7% but has improved compared to 106.1% in June. Tariffs will continue to be adapted based on the development of expected costs.

- General P&C continues to have an excellent combined ratio of 93.4% (-4.7 p.p.).

- Total Life business premiums increased 5.7%, with solid growth in both Savings and Protection. Life business continues contributing significantly to the result, both in the Savings as well as the Protection segment – the latter had a 67.5% combined ratio.

- The financial result continues to contribute positively in a favorable environment with growing portfolio yields.

- The net result reaches €283 million, of which Spain and Portugal contributed €273 million and €10.9 million, respectively. Net realized gains make up for €34.9 million (€9.9 million in 2023), after taxes and minorities. In 2023, the net result included a €46.5 million impact from the arbitration regarding the end of the Bankia alliance. Excluding the gains and the arbitration, earnings would have grown over 30%.

Business in LATAM continues being the Group’s largest contributor to earnings with €305 million and contributing over €7.7 billion in premiums

BRAZIL posts a result of €188 million with a strong contribution from the financial result

- In Brazil, premiums reach over €3.7 billion (-5.4%), and reflect the depreciation of the Brazilian real (-5.6%). In local currency, premiums grow 0.3%, with a slight fall in General P&C from a slowdown in Agro insurance contracts as a result of the uptick in interest rates. Life Protection premiums are down 1.0%, but up 4.9% in local currency.

- The Non-Life combined ratio improves significantly to 74.1%, thanks to a 3.7 point reduction in General P&C, which stands at an excellent 64.9% driven by the positive performance of the Agro business, as well as by the 1.7 point improvement in the Auto combined ratio, which stands at 101.1%.

- The Non-Life financial result is in line with recent quarters and portfolio yields are beginning to reflect the interest rate increases implemented by the Central Bank.

- The Life Protection business continues to contribute significantly to the result and posts a solid combined ratio of 84.2% (+4.5 p.p.).

The rest of the countries in LATAM maintain their strong contribution to growth and the result

- Premiums are up 9.1% in euros, while the net result stands at €118 million, with relevant contributions from Mexico and Peru. In local currency, there is noteworthy growth in Chile, Colombia, the Dominican Republic and Peru.

- The combined ratio improves to 99.0% (-2.9 p.p.), with positive developments in General P&C and Auto that offset the slight deterioration in the profitability of the Accident & Health business.

- Financial income and the Life business continue contributing positively.

- In Mexico, premiums reach nearly €1.4 billion (+12.9%), despite the slight depreciation of the peso (-1.4%). Both the Health & Accident line (+13.8%) as well as Life (+44.8%) have experienced strong business growth. The combined ratio stands at 98.6% and the net result reaches €38.6 million (+30.1%).

- In Peru, premiums reach €585 million (+3.4%), growing 5% in local currency, with a net result of €37.4 million (+33.5%).

- Hyperinflation adjustments, mainly from Argentina, had a €31.7 million negative impact on results (€34.6 million in 2023).

NORTH AMERICA consolidates a strong improvement in the result from the technical measures implemented

- Premiums reach over €2.1 billion (+3.0% in euros, +3.4% in local currency), of which the United States contributed close to €1.8 billion (+3.8%).

- The Non-Life combined ratio improves to 98.5% (-8.3 p.p), thanks to benign weather and the significant tariff adjustments being implemented.

- In General P&C, the combined ratio stands at an excellent 85.0% (-26.0 p.p.). The Auto combined ratio also improves substantially, reaching 100.8% (-6.7 p.p.).

- Puerto Rico business volume reaches €328 million, with a €15.3 million result.

- The region has a net result of €70.6 million, compared to losses of €18.8 million the previous year, which is an improvement of close to €90 million.

- Net realized gains amount to €0.7 million after taxes (€3.9 million in 2023).

The improvements in Turkey help to mitigate the challenging Auto market in other countries in EMEA

- Premiums stand at close to €1.1 million (+8.1% in euros), reflecting the improvement in all markets, with the exception of Malta, which continues to be affected by the fall in the Life business.

- Turkey posts a result of €24.0 million (+68.9%), thanks to the strong improvement of the combined ratio and a significant contribution from the financial result.

- Malta increases its contribution to earnings 12.5% to €4.4 million.

- The region significantly reduces its losses to €18.6 million (€31 million in 2023) which are due to the complicated Auto environment, mainly in Germany.

MAPFRE RE posts a solid result of €207 million (+9.3%) and continues strengthening levels of prudence in its reserves

- Premiums reach almost €6.3 billion (+3.5%). This includes the reinsurance business, which contributes more than €4.8 billion (+6.2%), and the global risks business, which contributes over €1.4 billion.

- The combined ratio is stable at 95.5% (+0.5 p.p.). The most relevant event for MAPFRE RE in the third quarter was the storms in Europe, with no other relevant catastrophic events. However, prudence levels continue to be strengthened in reserves in response to the increase in secondary perils and the recurrence of catastrophic events.

- The financial result increases its contribution. Net financial losses were realized during year for the amount of €0.5 million (€8.4 million in gains in 2023), after taxes and minorities.

- The net result reaches €207 million, which is a 9.3% increase.

MAWDY grows and improves its contribution to earnings

- Revenue, which includes premiums and service revenue, reaches almost €380 million (+8.3 %), and posts net earnings of €4.9 million.

Translation from the original in Spanish. In the event of discrepancy, the Spanish-language version prevails.