MAPFRE’s net result grows 46%, reaching 462 million euros in the first half of the year

- The intense improvement in profit mainly results from the higher contribution of the United States, Spain and the reinsurance business.

- NORTH AMERICA posts a relevant improvement in the result (+€58 million) thanks to the technical measures implemented.

- IBERIA’s result grows 37%, reaching €168 million.

- MAPFRE RE, which includes the reinsurance and Global Risks businesses, posts solid business growth, increasing its result to almost €140 million (+15%).

- LATAM, led by BRAZIL, is the highest contributor to the Group profit with €203 million.

- The adjusted ROE reaches 11.6%, and shareholders’ equity remains stable, surpassing €8 billion.

- The improvement in Non-Life continues, with a reduction in the combined ratio (-1.3 p.p.) to 95.7%, and a 12% increase in the financial result.

- Total premiums grow 5.5%, 6.5% in Non-Life, surpassing €15.1 billion, while revenue reaches over €17.7 billion.

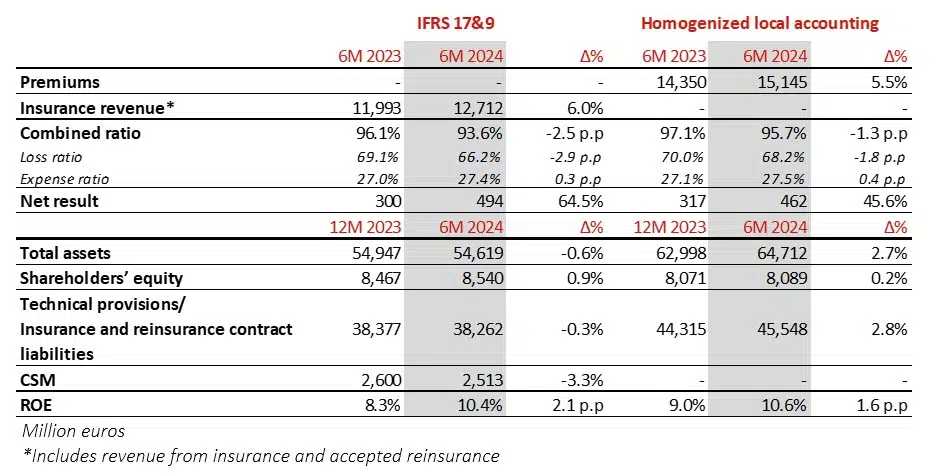

- Under the new international accounting standards IFRS 17&9, the net result increases 64.5% (€494 million), the ROE stands at 10.4%, and shareholders’ equity reaches €8.5 billion.

- At the close of March, the Solvency II ratio remains around 200%.

“The second quarter confirms the trend we are aiming for with the new Strategic Plan. The adjusted ROE is over 11%, we are growing profitably and solidly in the majority of countries and in all business units. We continue to improve the company’s combined ratio, adapting the Auto line in the markets where there are still complications” says Antonio Huertas, Chairman and CEO of MAPFRE.

MAPFRE S.A. hereby informs that, unless otherwise indicated, the figures and ratios in this activity report are presented under the accounting principles in force in each country, homogenized for comparison and aggregation between units and regions. As such, certain adjustments have been applied, the most relevant of which are the following: the elimination of the goodwill amortization in Spain and the elimination of catastrophic reserves in some Latin American countries. In Malta and Portugal, the applicable local accounting is IFRS 17 & 9. Definitions and calculation methodology for financial measures under IFRS 17&9 used in this report are available at the following link: https://www.mapfre.com/media/shareholders/2024/2024-07-alternate-performance-measures.pdf

1. IFRS ACCOUNTING

- MAPFRE S.A. applies the standards IFRS 17 regarding Insurance Contracts and IFRS 9 regarding Financial Instruments in the MAPFRE S.A. consolidated interim accounts submitted to the CNMV today.

Key figures – Comparison of IFRS and local accounting figures

2. HOMOGENIZED LOCAL ACCOUNTING

- Local accounting reflects the evolution of the different business units under the accounting criteria in force in each country.

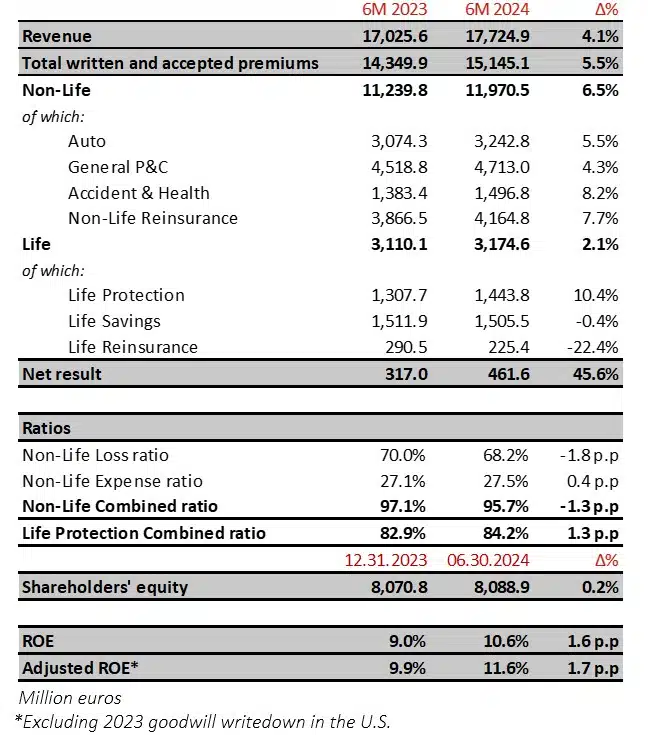

Key figures – Homogenized local accounting

- Premiums are up 5.5%, supported by the strong growth in business lines with a greater contribution to the result, especially General P&C, Life Protection and Reinsurance. By region, IBERIA and LATAM have contributed very positively. Growth in Auto reflects the technical measures and tariff adjustments. Life Savings is stable, with over €1.5 billion (-0.4%) in premiums, while Life Protection business grows 10.4%.

- The net result, which stands at €461.6 million, is up 46%, based on the following developments in the first half of the year:

a) The relevant improvement in Non-Life technical profitability from both technical measures in underwriting and tariff adjustments.

b) The growing contribution of financial income which, for the Non-Life business, reaches €401 million (+11.6%) in the first half of the year.

c) The relevant contribution of the Life business, both Savings and Protection, particularly in LATAM and IBERIA. Life Protection combined ratio continues at an excellent level (84.2%).

d) The effect of hyperinflation adjustments, with a €35.6 million negative net impact (€26 million in 2023), mainly from Argentina.

e) Various tax adjustments corresponding to previous years with a €25 million positive impact, most of which resulting from the declaration of partial unconstitutionality of Royal Decree-Law 3/2016.

- The Non-Life combined ratio improves 1.3 p.p. and stands at 95.7% with the following performance:

a) General P&C reaches an excellent combined ratio of 83.2%, (-2.7 p.p.), compensating the high loss experience that persists in other lines affected by inflation.

b) The Auto combined ratio improves 1.5 p.p. to 104.8%.

c) The Accident & Health combined ratio stands at 101.5% (+1.2 p.p.).

- Shareholders’ equity remains stable, reaching nearly €8.1 billion (+0.2%).

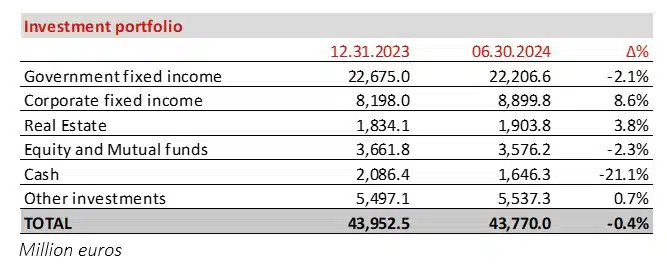

- The investment portfolio is shown below.

- The MAPFRE Group Solvency II ratio stands at 197.7% at March 2024, compared to 199.6% at the close of December 2023, stable and within the established target range. Neither figure includes the adjustment for transitional measures for technical provisions. If said adjustment were applied, the March 2024 Solvency position would reach 205.2%.

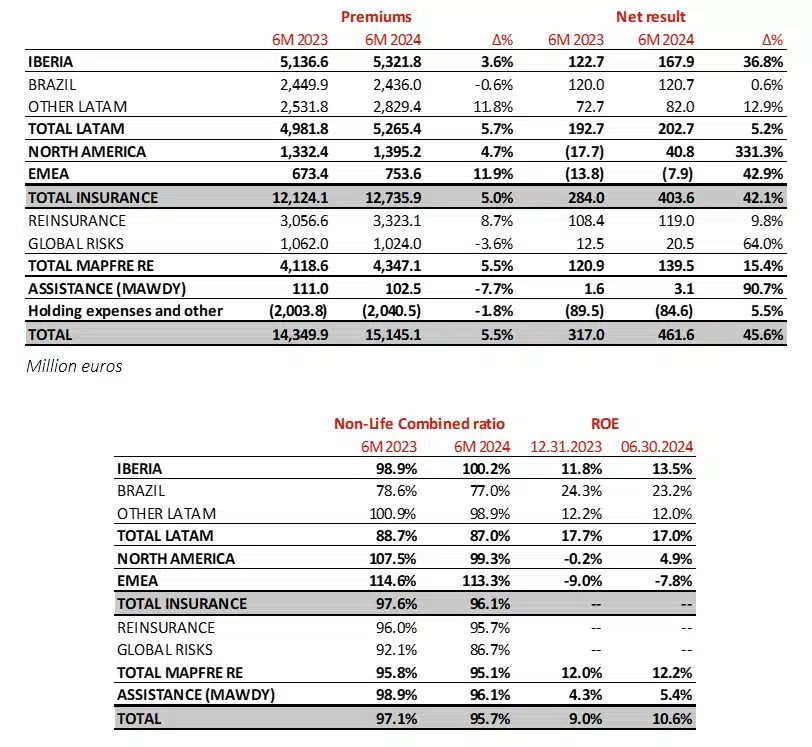

3. INFORMATION BY REGION AND BUSINESS UNIT (accounting criteria applicable in each country)

IBERIA maintains its solid leading position in the main lines of business with a focus on profitable growth, and its result grows more than 37%

- Premiums in IBERIA reach over €5.3 billion (+3.6%), with Spain standing out with nearly €5.1 billion (+1.5%). Premiums in Portugal reach €243 million (+84%) driven by the strong growth in Life Savings.

- Non-Life premiums are up 6.4% and reflect the positive development of General P&C (+6.9%), driven by Homeowners and Condominium lines, and Accident & Health (+6.8%). In Auto, premiums are up 5.7%.

- The Non-Life result and combined ratio are affected by the Auto business which has a combined ratio of 106.1% and is experiencing tension from an increase in bodily injury costs. Tariffs will continue to be adapted based on the development of expected costs.

- General P&C continues to have an excellent combined ratio of 94.9% (-0.8 p.p.).

- Life business continues contributing significantly to the result, both in the Savings as well as the Protection segment – the latter had a 67.9% combined ratio (-1.2 p.p.). Total Life premiums (-3.1%) are affected by the extraordinary issuance in 2023, while Life Protection premiums are up 4%.

- The financial result continues to improve in a favorable environment.

- The net result reaches €167.9 million, of which Spain and Portugal contributed €161.4 million €6.5 million, respectively. Net realized gains make up for €33.4 million (€6.9 million in 2023), after taxes and minorities, including the sale of a building.

Business in LATAM shows strong growth and continues being the Group’s growth engine and largest contributor to earnings with €203 million. Premiums are up 5.7%, reaching nearly €5.3 billion

BRAZIL consolidates solid growth with a net result of €121 million, reflecting improvements in the technical result and the strong contribution of the financial result

- In Brazil, premiums reach over €2.4 billion (-0.6%), and reflect a slight depreciation of the Brazilian real (-1.5%). In local currency, premiums grow 0.9%, with a slight fall in General P&C (-0.6%) from a fall in issuance in Agro business due to the subsidy allocation calendar, while Life Protection premiums are up 6.2%.

- The Non-Life combined ratio improves significantly to 77.0%, thanks to a 2.5 point reduction in the Auto combined ratio, which stands at 101.6% as a result of the previously implemented tariff adjustments. The General P&C combined ratio stands at an excellent 68.6%, supported by the strong performance of the Agro business despite the floods in the Rio Grande do Sul region, which had an impact on the region’s net result of under €6 million.

- The Non-Life financial result is in line with recent quarters.

- The Life Protection business continues to contribute significantly to the result and posts a solid combined ratio of 82.4% (+2.1 p.p.).

The rest of the countries in LATAM maintain their strong contribution to the result

- Premiums are up 11.8%, while the net result stands at €82 million, with relevant contributions from Mexico and Peru. Written premiums grow in local currency, with noteworthy performance in Chile (24.6%), Dominican Republic (11.9%) and Peru (8.6%).

- The combined ratio improves to 98.9% (-2 p.p.), with positive developments in General P&C and Auto that offset the slight deterioration in the profitability of the Accident & Health business.

- Financial income maintains its upward trend and the Life business increases its contribution.

- In Mexico, premiums reach close to €1.1 billion (+17.4%), also driven by the appreciation of the peso (+5%). Both the Auto line as well as Life have experienced strong business growth. The combined ratio stands at 98.3% and the net result reaches €26 million (+22%).

- In Peru, premiums reach €384 million, growing 7.8%, with a net result of €25.5 million.

- Hyperinflation adjustments from Argentina had a €26.9 million negative impact on results (€21.1 million in 2023).

NORTH AMERICA posts a strong improvement in the result, due to the technical measures implemented

- Premiums reach nearly €1.4 billion (+4.7%), of which the United States contributed close to €1.2 billion (+5.5%).

- The Non-Life combined ratio improves to 99.3% (-8.3 p.p), thanks to benign weather and the significant tariff adjustments being implemented.

- In General P&C, the combined ratio stands at 89.7% (-19.1 p.p.). The Auto combined ratio also improves substantially, reaching 101% (-7.7 p.p.).

- Puerto Rico business volume increases slightly, reaching €219 (+0.8%), with a €9.8 million result.

- The region has a net result of €40.8 million, compared to losses of €17.7 million the previous year, which is an improvement of nearly €60 million.

- Net realized gains amount to €0.4 million after taxes (€4.2 million in 2023).

EMEA continues improving

- Premiums stand at €754 million (+11.9%), reflecting the improvement in the Auto business compared to the previous year, though they are still affected by the fall in the Life business in Malta.

- In Turkey, the positive performance of the financial result offsets the effect of inflation, leading the country to report more than €15 million in earnings in the first half of 2024, while Malta continues to have a recurring contribution to earnings.

- The region posts €7.9 million in losses as a result of the complicated Auto environment mainly in Germany and to a lesser extent in Italy, but improves significantly compared to €13.8 million in losses in 2023.

MAPFRE RE consolidates solid growth with a strong contribution to the result

- MAPFRE RE premiums, which include the reinsurance and global risks businesses, reached over €4.3 billion (+5.5%), of which €3.3 billion come from the reinsurance business (8.7%), and over €1 billion (-3.6%) from global risks.

- The combined ratio improves to 95.1% (-0.6 p.p.), supported by the recovery of tariffs, especially catastrophic covers. The most relevant event for MAPFRE RE in the first half of the year was the flooding in the Rio Grande do Sul region in Brazil, which had a €41-million net impact on the Group’s attributable result. There have been no other relevant catastrophic events, but there has been an increase in medium intensity claims. In the same period in 2023, there was an earthquake in Turkey with a net impact of €99 million.

- The financial result continues increasing its contribution, and as such, the net result reaches €139.5 million, which is a 15.4% increase.

- Net financial losses were realized during year for the amount of €0.9 million (€7.3 million in gains 2023), after taxes and minorities.

MAWDY grows and improves its contribution to earnings

- Revenue, which includes premiums and service revenue, reaches €253 million (+9.6%), and posts net earnings of €3 million.