CORPORATE | 28.07.2023

MAPFRE’s business is growing 15% in the first half

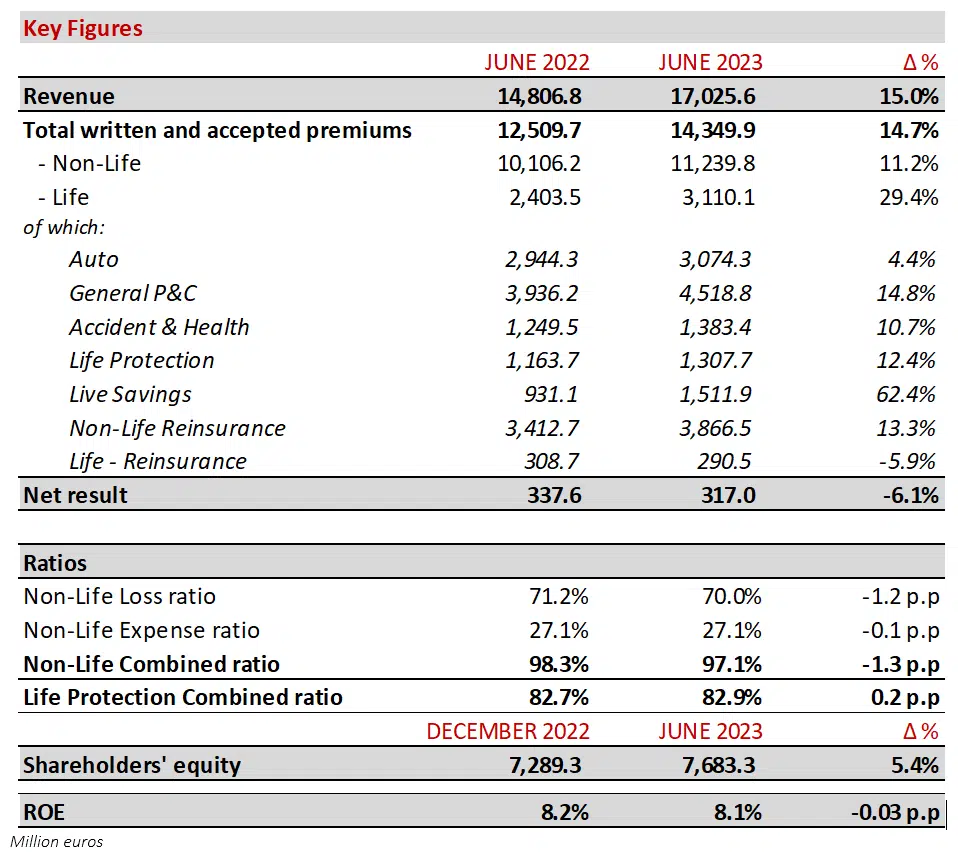

- Revenue is up 15% and stands at over €17.0 billions.

- The net result reached 317 million (-6%), affected by the situation in Auto and the earthquake in Turkey.

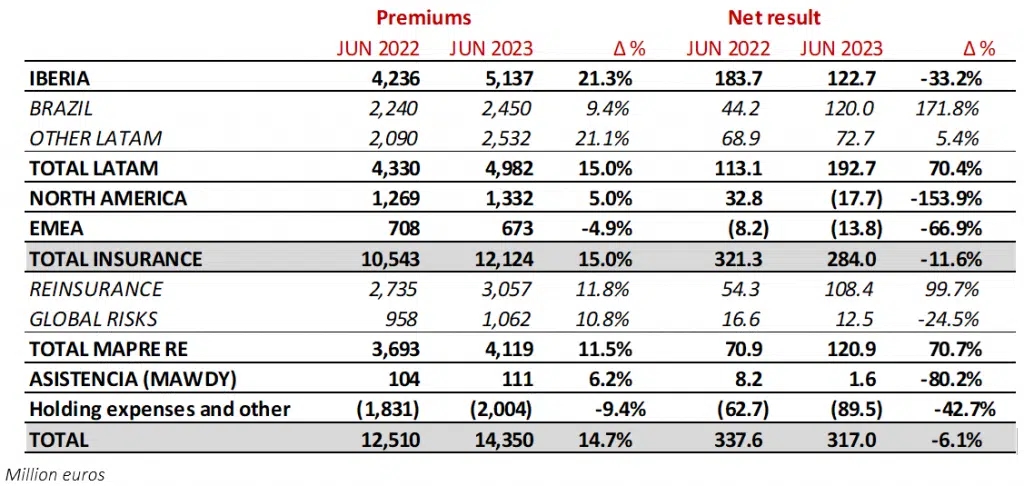

- IBERIA is the business with the highest growth, with an increase of over 20%.

- LATAM, with net results soaring to €193 million, is the main contributor to earnings.

- Improvement in Non-Life, with a lower combined ratio (-1.3 p.p.), mainly in General P&C, and higher contribution from the financial result (+26%).

- Increase in Life premiums (+29%) and improvement in the Life technical financial result (+16%).

- MAPFRE RE’s contribution to results rose to €121 million, with solid business growth.

- MAPFRE S.A. presents its accounts under the new accounting standards IFRS 17 & 9 for the first time.

“The strength that our great diversification gives us is compensating all the difficulties that the Auto line continues to face from inflation. In IBERIA, premiums are growing over 20%, while business in LATAM is also showing strong growth, where anti-inflation measures were adopted earlier and are starting to be seen in the result. MAPFRE RE has contributed significantly to the result,” says Antonio Huertas, Chairman of MAPFRE.

*DISCLAIMER: MAPFRE S.A. (MAPFRE) hereby informs that, unless otherwise indicated, the figures in this activity report are presented under the accounting principles in force in each country, homogenized for comparison and aggregation purposes. Additional information is available in the Annex herein.

- The 15% increase in revenue consolidates the trends from recent months and reflects both a relevant increase in business volume as well as an improvement in financial income.

- Premiums are up 14.7%, with no relevant impact from exchange rates (at constant rates, premiums are up 15.1%). This growth reflects a general improvement in business, with an 11.2% increase in Non-Life and a 29.4% increase in Life, mainly due to performance in Spain and Brazil. These premiums were also driven by the renewal of a two-year industrial risk program in Mexico, recording €307 million corresponding to the first year.

- Regarding Non-Life, premiums are up over €1.1 billion in the first half, with 14.8% growth in General P&C, 10.7% growth in Accident & Health and 4.4% in Auto. The combined ratio stands at 97.1% (-1.3 p.p.), and the volatility and dispersion from previous quarters marked by the economic scenario remain. General P&C, with a combined ratio of 85.9% (-4.1 p.p.) has compensated the high loss experience that persists in the Auto business, where the combined ratio has reached 106.2% (+1.1 p.p.) but is slightly better compared to March this year. In some regions, tariff increases and management efficiencies are beginning to translate into lower Auto combined ratios. Accident & Health shows improvement in the combined ratio compared to the first half of the previous year, at 100.4% (-1.9 p.p.). The Non-Life financial result reached 359 million euros, up over €74 million euros and equivalent to growth of 26%.

- In the Life business, premiums are up over €700 million, driven by the Life Savings business in Spain. The result for this line has benefitted from both good technical performance as well as strong financial income, especially in Latin America. The Life Protection combined ratio remains at an excellent level (82.9%). All these factors led to a 16.4% improvement in the Life technical-financial result compared to the previous year.

- The earthquake in Turkey has been the main relevant Nat Cat event of the first half of the year. MAPFRE RE has updated its estimates, based on the losses reported in recent months. At the close of June, an impact on the net result of €104 million has been estimated, primarily affecting MAPFRE RE (€99 million) and, to a lesser extent, the local insurer (€5 million), and no further relevant losses are expected to be reported in the coming months. In 2022, the most relevant Nat Cat claim for the company was the drought in Brazil, with an €88-million net impact for the Group. The absence of other relevant cat events and the favorable reinsurance market have made it possible for MAPFRE RE to reach a result of €121 million, as the impact of the earthquake claim has been offset by the positive result from other businesses and regions.

- Both the hyperinflation adjustments as well as the fall in the result for Other Activities have negatively impacted the net result.

- Regarding the investment portfolio, detail of which is provided in the chart below, there was no relevant change in the asset allocation during the first half of the year, and MAPFRE has realized €18.4 million euros in net gains in the first half of the year, after tax and minorities (€22 million in 2022).

- Shareholders’ equity for the Group at the close of the first half of the year, under homogenized local criteria, reached nearly €7.7 billion, €394 million more than at the close of 2022, equivalent to 5.4% growth. The drivers for this growth were a recovery of the value of available-for sale investments (€295 million) and an increase in positive currency conversion differences from the appreciation of Latin American currencies (€82 million).

Information for regions and units

IBERIA is growing above the market both in Life and Non-Life

- Premiums in IBERIA surpass €5.1 billion (+21%), with Spain standing out with €5.0 billion (+21%). Premiums in Portugal stand at €132 million (+36%).

- The Life business volume is 1.7 times higher than the previous year, reaching over €1.5 billion, of which over €1.3 billion correspond to Life Savings (€677 million in 2022).

- Non-Life premiums are up 7.7% and reflect the positive development of the General P&C business (+9.3%), driven by Commercial lines, as well as the Accident & Health (+8.8%) and Auto (+4.8%) businesses.

- In Auto, tariffs continue to be gradually adapted to the inflationary context and based on individual risk profiles. The portfolio stands at 6.2 million insured vehicles, with a slight reduction in the first half of the year related to risk-selection measures. The increase in average premium is estimated to be around 5.5%.

- The Non-Life result and combined ratio have been affected by the Auto business, where the combined ratio stands at 103.5% (+3.5 p.p.). This line is affected by the recovery of mobility to pre-pandemic levels, the high inflationary scenario, and the Baremo update. The combined ratio showed an almost 6-point improvement in the second quarter compared to the previous quarter. The development of this indicator during the rest of the year will be based on strict cost control, while the necessary tariff adaptations will be based on the development of expected costs.

- General P&C, driven by Commercial lines as well as the Life Protection business, continues contributing positively to results, with combined ratios of 95.7% and 69.1%, respectively.

- The financial result continues to improve in a more favorable environment, with a €69.1 million gross contribution to the Non-Life result (65.7 million in 2022).

- The net result stands at €122.7 million, of which Spain contributed €116.9 million and Portugal €5.8 million. Of this amount, €6.9 million correspond to net realized gains (€9 million in 2022), after tax and minorities.

Business in LATAM is consolidating the strong trends of recent quarters with close to €5.0 billion in premiums and a result of €193 million, the largest contributor to Group earnings.

BRAZIL is showing strong growth and its result nearly tripled thanks to improvements in both the technical and financial result

- In Brazil, premiums reached almost €2.5 billion (+9.4%), despite a slight depreciation of the Brazilian real (-0.4%). This improvement in written premiums is due above all to the positive development of the Agro Insurance and Life Protection businesses, which grew in euros 10% and 13.9% respectively.

- The Auto business is up 1.5%. This line continues to quickly adapt tariffs to inflation. The portfolio reached over 1.2 million insured vehicles, with a slight reduction in the year related to risk-selection measures.

- The combined ratio for the region has reduced significantly to 78.6%, due in part to a 16-percentage point improvement in the Auto line compared to the previous year, after tariff updates, and a 2.5 percentage point compared to the first quarter of this year. The combined ratio in Auto stands at 104.1%. Additionally, the Agro business improved its positive development in a year without weather-related events, after the losses recorded in 2022 from the drought, and the General P&C ratio stands at an excellent 68.9%.

- The Non-Life financial result continues to contribute very positively, with a €44.4-million euros gross contribution (€37.5 million in 2022).

- The Life Protection business also has a solid combined ratio, standing at 80.3%. The financial result also improved, backed by the high interest rates in the country.

The rest of the countries in LATAM improve their contribution to the Group result

- Premiums in the region grew 21.1%, while the net result reached €73 million, with relevant contributions from Mexico and Peru. Written premiums in local currency grew in all countries in the region, with noteworthy growth in Mexico (32%), Colombia (20%), Panama and the Dominican Republic (13%) and Peru (8%).

- The combined ratio rose to 100.9% due to an uptick in General P&C that is partially offset by an improvement in the Auto business.

- The Life business and financial income continue improving and contributing positively to results.

- In Mexico, premiums reached €904 million, up 48.7%, driven by the renewal of the already mentioned industrial risks program and the favorable performance of the Mexican peso, which appreciated 13%. The net result reached €21 million, improving 77% compared to June 2022. The combined ratio stands at 96.9%, (+2.5 p.p.), mainly due to the Accident & Health line.

- In Peru, premiums reached €356 million, growing 10.3%, while the net result reached €17.7 million. The combined ratio in the country rose to 102.2% in the first half, both as a result of the weather-related impacts of the coastal El Niño, as well as from the rioting from the political instability which has especially affected the General P&C line.

NORTH AMERICA business volume is increasing, supported by tariff updates

- Premiums reached over €1.3 billion in June, growing 5%. The largest contributor was the United States with over €1.1 million and 4.7% growth. Puerto Rico recorded a 6.3% increase, reaching €217 million in premiums.

- The Auto business recorded 4.7% growth. The portfolio stands at 1.4 million insured vehicles, with a slight reduction in 2023.

- The Non-Life combined ratio stands at 107.5%, affected by the inflationary environment.

- The Auto combined ratio stands at 108.7% (+4.5 p.p.), a 3.7 p.p increase compared to the previous quarter (105%). Claims frequency is stable, and already-implemented tariff increases should compensate the current increase in claims costs.

- In General P&C, the combined ratio stands at 108.8%, affected during the first half by weather-related events (Arctic Freeze), with a net cost of 18 million euros.

- In May 2023, tariff increases were implemented in the Auto line (6.5%) and the Homeowners line (15%).

- Net realized gains reached €4.2 million, after tax (€14.4 million in 2022).

EMEA

- Premiums reached €673 million, a 4.9% decrease, which reflects the deceleration in the Life business in Malta. The region recorded €13.8 million in losses, mainly related to the complicated Auto environment in Italy and to the earthquake in Turkey with a €5 million net impact.

MAPFRE RE is consolidating its strong growth and increasing its contribution to earnings

- MAPFRE RE premiums, which include the reinsurance and global risks business, grew 11.5%, surpassing €4.1 billion, supported by non-proportional contract growth. On a risk-adjusted basis, the catastrophic business rates are growing above 20%.

- The reinsurance business grew 11.8%, and the global risks business 10.8%.

- The combined ratio improved significantly in the quarter, reaching 95.8%.

- The only relevant event in the year has been the earthquake in Turkey, with an estimated gross cost of €140 million, and a €99-million impact on the Group net result.

- The financial result is also growing, with a €61.2-million euro gross contribution to the Non-Life result (€34.1 million in 2022). During the year, net gains of €7.3 million euros were realized (-1.1 million in 2022), after tax and minorities.

- The net result reached €121 million, a 70.7% improvement.

ASISTENCIA (MAWDY) continues to focus on strategic markets for the Group, with a focus on more digital activity

- Revenue reached €231 million, growing 9.3%, and showing a slight profit.

Appointments

- The Board of Directors of MAPFRE has appointed Board member Francesco Paolo Vanni d’Archirafi as President of the Audit and Compliance Committee of MAPFRE, replacing Ana Isabel Fernández, who is stepping down from her role as president of this Committee, as on August 18 she will have reached the end of her four-year period in this role.

Arbitration for the resolution of the bancassurance alliance with Bankia

At the end of 2021, CAIXABANK (as the current owner of BANKIA) and MAPFRE entered into arbitration regarding the discrepancy related to the BANKIA-MAPFRE bancassurance alliance existing at that time, concerning MAPFRE’s right to receive 120 or 110 percent of the market value of the Life and Non-Life businesses of said alliance. This controversy was resolved yesterday with the communication of the decision that the Court of Arbitration of Madrid has issued in favor of MAPFRE, recognizing the right to receive 120 percent. Considering the market value that was determined by the independent expert, and without prejudice to the legal proceedings initiated by MAPFRE questioning said market value, the resolution would imply MAPFRE’s right to receive from CAIXABANK an additional 53 million euros.

ANNEX

Application of the new International Financial Reporting Standards (IFRS) 9 & 17

In 2023, the Group has applied the standards IFRS 17 regarding Insurance Contracts and IFRS 9 regarding Financial Instruments, for the first time, in the MAPFRE S.A. consolidated interim financial statements submitted to the CNMV today.

Under the new accounting criteria, the key figures for the first half would be as follows:

- Basis of presentation – homogenized local accounting criteria: The 2023 figures and data included in this document under homogenized local accounting criteria were obtained from the financial statements prepared by MAPFRE Group companies, according to the applicable accounting principles in each country. In order to achieve homogeneity in the results and ratios between units and regions, certain adjustments have been applied to the 2023 figures, the most relevant being: the elimination of the goodwill impairment in Spain and the elimination of Nat Cat reserves in some countries in Latin America.

- The comparative data reflects the figures reported by the Group under the new international accounting principles. For more detail, see the information regarding IFRS 9 and 17 in the MAPFRE Group 2022 consolidated annual accounts, and the Interim Financial Statements to June 2023, available on the CNMV and on MAPFRE’s website.